Volume 6, Issue 1 (1-2022)

EBHPME 2022, 6(1): 23-40 |

Back to browse issues page

Download citation:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

Noori Hekmat S, Rahimisadegh R, Mehrolhasani M H, Jafari Sirizi M. Understanding Health Insurance from the Perspective of an Ecosystem: A Systematic Review and Meta-Synthesis. EBHPME 2022; 6 (1) :23-40

URL: http://jebhpme.ssu.ac.ir/article-1-363-en.html

URL: http://jebhpme.ssu.ac.ir/article-1-363-en.html

Somayeh Noori Hekmat

, Rohaneh Rahimisadegh *

, Rohaneh Rahimisadegh *

, Mohammad Hossein Mehrolhasani

, Mohammad Hossein Mehrolhasani

, Mohammad Jafari Sirizi

, Mohammad Jafari Sirizi

, Rohaneh Rahimisadegh *

, Rohaneh Rahimisadegh *

, Mohammad Hossein Mehrolhasani

, Mohammad Hossein Mehrolhasani

, Mohammad Jafari Sirizi

, Mohammad Jafari Sirizi

Department of Health Management & Policy & Economics, Faculty of Management and Medical Information Sciences, Kerman University of Medical Sciences, Kerman, Iran , rhn.rahimi@gmail.com

Full-Text [PDF 5113 kb]

(621 Downloads)

| Abstract (HTML) (1653 Views)

Discussion

The health insurance ecosystem involves all the organizations and institutions who act in this field based on its objectives, values and functions. A comprehensive understanding of the elements (performances and functions) and actors of this ecosystem can be effective in improving its current status and in the future.

The findings of the present study indicated that the most important objective of the health insurance ecosystem is creating a fair participation in financing and financial protection of the insured, which is done based on the values such as quality, justice, access, satisfaction, and population coverage. The most important functions of the ecosystem are governance, financing, service delivery, and resource production, while the Ministry of Health and Welfare is the key actor in the ecosystem. In some countries such as Korea, these two ministries work under one ministry. The key point is that there is a close relationship between the functions and performances of this ecosystem, and it is not often separable. In addition, the positive or negative results of each can directly or indirectly influence one another. Even the actors affect the functions and performances of the ecosystem, either in terms of the role of the actor, or the combination of the roles of actors and the relationships between them. Then, the objectives, values, functions, and actors of the ecosystem were discussed in detail.

Objectives and values of the health insurance ecosystem

The most significant objective of the health insurance ecosystem is to create financial protection and fair participation in financing, in line with the universal health coverage. Since financing a major part of the health system in many countries is conducted through the insurance system, insurance organizations play a key role in achieving the objectives of the health system, especially health promotion and fair financial participation (2), so that using policies such as population coverage and expenses coverage of services by insurance organizations help the implementation of a fair participation in financing (41).

Financial protection of people against health costs, along with the improvement of public health, as well as responding to people's expectations are known as the objectives of the health system, and is among the consequences of establishing prepayment mechanisms regarding public health coverage (40, 45). Efforts to establish fair systems, executive guarantees for access to high-quality health care services, and financial protection of everyone in society are among the most serious challenges for the health systems, especially in developing countries (4). Lack of financial protection is considered a disease of health insurance ecosystems, a clear indication of which is that households would suffer not only from the burden of disease, but also from the burden of poverty and economic hardship due to the debilitating costs of their health (24). Despite governments' efforts to provide financial protection for individuals, they may not be able to create such conditions (40).

Functions of health insurance ecosystem

In the national health insurance ecosystem of many countries, in addition to taxing the salaries of employees and employers (38), the government takes a percentage of premiums as subsidy. In some countries such as Iran, where the government subsidies are derived from the sale of crude oil and are subject to fluctuations with respect to the world oil prices, they are regarded as an unsustainable source. For this reason, it is better for sustainable sources such as taxes (income tax, value-added tax) to form a larger share of the financial resources in the health insurance ecosystem (46).

Tariff is regarded as one of the most significant tools of health and insurance system's policy makers in any country which is effective respecting justice, efficiency, quality and accountability in service delivery, and can affect the level of access and use of services (47). Tariff in the health insurance ecosystem is associated with some challenges such as unrealistic tariffs, lack of up-to-date tariffs, and multi-tariff services in the public and private sectors (48). If the service tariff is not real and there is fragmentation in the insurance system, it will be impossible to make strategic purchases in a real way in the health insurance ecosystem (44).

In recent years, the service package defined for the insured in the ecosystem has been developed extensively without reviewing, while the increase in the income of the insurance companies (increase in premiums) has not been in line with it, leading to incompatibility between budget, premium per capita, and financing of service package by insurance organizations (41). Lack of balance between income and expenses of the insurance organizations, as well as the need for cost management, have been investigated in several studies (38, 43, 44). In particular, the development of prevention and health service coverage such as referral systems based on family physician programs in some countries is the primary key for health policy makers and planners to achieve the objectives of the health insurance ecosystem. Factors such as long-term debts and non-timely repayment of insurance organizations to prevention services are considered major challenges for the development of insurance services (49). In addition to the development of the covered services, one of the values mentioned in the studies (38, 39, 43, 44) is the quality of services, which is a significant precondition for the introduction of a health insurance ecosystem (40).

Another function of the health insurance ecosystem is its governance. In this field, the subjects such as conflict of interest, insurance structures, and the multiplicity of insurance funds are the issues addressed in further studies. Conflict of interest is considered a serious challenge in health systems. One of the factors leading to the conflict of interest is the presence of insurance funds and organizations with various and specific structures and laws (43). Furthermore, another challenge related to the structure of the insurance system in the health insurance ecosystem is the conflict of interest in relation to the role of actors in the ecosystem. For instance, if the role of buyer (insurer) and provider is played by an actor from the ecosystem, it will create a conflict of interest and prevent the implementation of strategic purchases (21), or a conflict of interest will occur when physicians take on governance roles in addition to playing the role of provider (43).

The presence of multiple insurance funds leads to many challenges in the health insurance ecosystem, which have been addressed in this and other studies. For example, lack of information transparency, inability to plan appropriately due to the differences in revenues and costs of different insurance funds, difference in levels and types of commitments, services approved by insurance organizations in the health insurance ecosystem, impossibility of supervision on services provided by insurance organizations and multiple insurance funds, and differences in the types of services provided to individuals (44, 50). By accumulating, combining, and integrating different funds and organizations in a single structure, premiums can be reduced after subtracting the organizational costs and funds (44). Thus, different countries have implemented health financing by establishing a single organization or insurance fund to strengthen risk accumulation, financial protection, and improve equality and efficiency, which is accompanied by great political resistance. Interactive policies can be applied to improve the relationships and interactions between relevant actors. This issue should be dealt with by actors with executive roles in the health insurance ecosystem (46, 51).

Actors of the health insurance ecosystem

Actors are considered another key element of any ecosystem, and it would be impossible to make any reforms to the health insurance ecosystem without appropriately identifying and analyzing the role and effect of the actors. In studies conducted in Turkey and Afghanistan to evaluate the effect of reforms on the health system and the implementation of new reforms, the related actors were identified and analyzed in terms of strength, influence, and effectiveness (20, 52). In this way, policy makers and managers can implement the desired reforms, policies and programs in a desirable and effective manner (39).

In all the papers, the Ministry of Health was regarded as an actor in the health insurance ecosystem, followed by the Ministry of Welfare as the main actor. Some of the studies revealed the significance and effect of the Ministry of Health in using policies and strategic planning at the national level and their implementation at the regional level (37, 42). The Ministry of Health, as the custodian of the health system, has great power and a supportive role in the health insurance ecosystem (13, 41). Therefore, it seeks to respond and provide higher access to health services for individuals, while the Ministry of Cooperatives, Labor and Social Welfare deals with the balance of resources and the costs of health insurance organizations (41). The analysis of communication network between the key actors with executive roles regarding policy-making in the health insurance ecosystem indicated that the Ministry of Health and Health Insurance Organization play a major role in the policy-making network (38).

In some countries such as Korea, the two Ministries of Health and Welfare are considered under one entity. In a country like Iran, since the health insurance mechanism is under two Ministries of Health and the Ministry of Welfare, participatory and coordinating structures such as the Supreme Council of Health Insurance and the Coordination Council of Basic Insurance Organizations have been established to play the role of legislative governance and regulator as intermediary structures. In the health insurance ecosystem, a role such as the insured has been generally defined as the individuals covered by insurance services, including a wide range of people such as employees, workers, villagers, and vulnerable people. In terms of frequency, compared with other roles, the insured forms a large part of the health insurance ecosystem. Since this role is played by only one actor, it had little effect, and it was seen that studies have not considered it an ecosystem actor (37, 39, 40). Almost half of the health insurance ecosystem involves a variety of governance roles such as regulatory, legislative, policy-making, and financial, indicating their significance and effect on the health insurance ecosystem. The role of supporting organizations and institutions with the most actors, have become more highlighted in the countries which face the lack of budget for insurance organizations, and have increased the role of supporting organizations and institutions such as associations and international organizations (13, 37, 38, 40).

The separation of the buyer from the provider is defined as a measure in which the buyer, as someone who makes decisions about what services should be provided by the provider, is separated from the provider who should provide services and agreed outputs (53). Due to the structural differences between health systems in various countries, it is difficult to compare and evaluate the effects of this separation on the health system (54, 55) and scientific evidence, as well as different and controversial results on the effects of buyer and provider separation on the values such as increasing efficiency and improving the service quality (56, 57). It is suggested to do this separation due to the numerous and controversial discussions which exist in this field in the health insurance system of Iran.

Although many studies have evaluated the actors related to issues such as service packages, fund aggregation, insurance plans, etc. in the insurance ecosystem through a stakeholder analysis approach, no study has investigated the key elements and actors with a comprehensive approach. Therefore, the present study aimed to fill this research gap. One of the limitations of this study was that although no specific limitation in terms of time (year) and location (country) was considered in the search strategy, the studies on health insurance ecosystem, which were discovered and entered into the research and meta-synthesis, involved only middle-income countries. More than half of the studies considered Iran in a mixed insurance structure (basic and supplementary insurance with multiple structures and funds), and the countries which had a national medicine system and a single insurance system and faced fewer challenges in the health insurance ecosystem, were not included in the present study.

Conclusion

The findings of this study, presented in the form of performances (objectives and values), functions, and actors of the health insurance ecosystem, indicated that fair participation and financial protection as the objectives of the health insurance ecosystem is realized through the ecosystem functions of governance, resource provision, and service delivery in the context of an integrated and transparent structure. Governance as the most significant role of the ecosystem, whose actors with various levels of governance half of the ecosystem roles, divides different roles and tasks among the actors. In addition, it encourages the required participation and coordination and regulates interactions between actors with different roles through the mechanisms such as tariffs and payment system. The presence of too many actors with different roles or different roles played by an actor in the ecosystem may result in complexity and conflict of interest.

Implementing reforms in financing and insurance system of countries entails great significance and high priority, and an emphasis on adding prevention and health-oriented services to the service package. This has created a unified insurance system to optimize risk accumulation and distribution to increase the financial protection of individuals during the recent years.

Based on the results of the present study, the actors such as the Ministry of Health in every country are known as the most important actors in the health insurance ecosystem along with other actors such as the Ministry of Welfare and Economy. In order to reduce the complexity and multiplicity of the roles of an actor, the other actors in the governance of the ecosystem such as financial, regulatory, and legislative governance are required to play a role in line with the structure of each country.

The results of the present study help health insurance policy makers to recognize key actors in the health insurance ecosystem and make the required modifications by focusing on their power, role, and influence on other actors and the ecosystem functions.

Acknowledgements

Non applicable.

Conflict of interests

The authors declared no conflict of interests.

Authors' contributions

Noori Hekmat S, Rahimisadegh R, Mmehrolhasani MH, and Jafari sirizi M designed research; Noori Hekmat S, Mmehrolhasani MH, and Jafari sirizi M conducted research; Rahimisadegh R, Mmehrolhasani MH analyzed data; and Rahimisadegh R and Mmehrolhasani MH wrote the paper. All authors read and approved the final manuscript.

Funding

Non applicable.

Full-Text: (520 Views)

Introduction

Health is consideredone of the main axes of improving the quality of human life in all countries (1). Based on the definition provided by the World Health Organization, the finalobjective of health systems is to maintain and promote public health,respond to their expectations fairly, and protect them from harms and the financial burden of diseases (2).Financial protection means that people should not become poor because of illness and using health services, or be forced to choosebetween their health and economic well-being (3).Efforts to improve financial protection and access to health services form the basis of financing and insurance system (4) since the philosophy of insurance is financial protection of the insured (5), and the results of many studies acknowledge that(6-11).

Health insurance is regarded as an asset for supporting the health system and the health level of the individuals in communities. Insurance companies normally play the role of an intermediary organization in transferring capital from the consumer of the health service to its provider(12).Health insurance uses revenue collection, accumulation, and management (risk accumulation and distribution), as well as the allocation of resources to satisfy the health needs(purchase of services)for people to stay healthy and strongat the time of disease (2, 5).Due to such different functions of the health insurance, health policy makers can carry outvarious reforms in the health and insurance system (5).For any reform in health care financing, it is necessary to distinguish between the objectives of health financing policy (e.g. improving financial protection and access to services) and its tools (e.g.making insurance plans, modifying payment methods, etc.).In addition, any reform should be instituted in terms of their effect on people and the system as a whole (3). Indeed, decision makers and policy makers will have a better chance of implementing reforms by learning about the health system and its effective elements (13).

In recent years, there has been a strong inclination towardsusing ecosystem as a new approachto explain and interpret business environments and systems, such as the health insurance system (14).Business ecosystems as an economic community is the interaction of various organizations, individuals and institutions including different customers, manufacturers, competitors and stakeholders (15) who are interrelated and interdependent (16).Business ecosystem theory is a tool whichdescribes today's business environments systematically,and analyzes the potential effects of various organizations' decision-making on each other in a network (17).Thus, policy makers and planners of differentareas such as health should expand their knowledge of ecosystem analysis before planning and implementing any reform in the financing system and health insurance. In addition, they should gain knowledge on the elements of health insurance ecosystem and the relationships between them toappropriately respond to changes in this ecosystem (18).

Although many studies have been conducted in different countries on health system reforms,financing system, and health insurance (19-24), no study has comprehensively analyzed the elements of this field with an ecosystem approach. Since meta-synthesis studies are valuable for a comprehensive knowledge and deep understandingregarding the phenomenon under study, and help to make decisions based on scientific evidence and the research findings (25,26), the systematic review and meta-synthesis method were used to explain the key elements (objectives, values, performances and functions) and actors of the health insurance ecosystem.This paper was part of another study aiming to design the health insurance ecosystem.

In this study, an effort was made to answer the following key questions: Who are the actors in health insurance ecosystem? What are the objectives of the health insurance ecosystem? What are the values of the health insurance ecosystem? What are the functions of the ecosystem treatment?

Materials and Methods

Systematic review studies aim to identify, evaluate, and summarize the findings of separate studies related to a specificsubject, and facilitate access to existing evidence for policy makers (27).Meta-synthesis attempts to integrate the results of different but related qualitative studies. This technique, unlike meta-analysis of quantitative studies, is assumed to be interpreted rather than aggregated. Qualitative meta- synthesis is defined as theories, macro-narratives, generalizations, or interpretive translations that result from integration or comparison of the findings of qualitative studies(28).This study aimed to investigate the key elements and actors of the health insurance ecosystem, and analyze and combine the findings of the systematic review in the form of meta-synthesis using the six-step Walsh and Downetechnique (29).

Search strategy

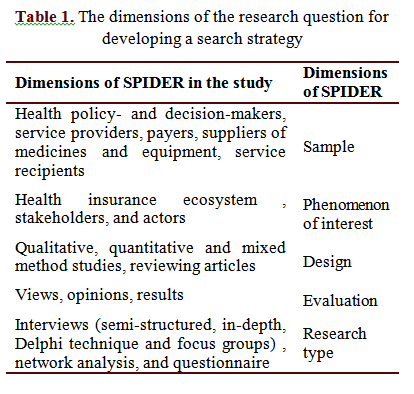

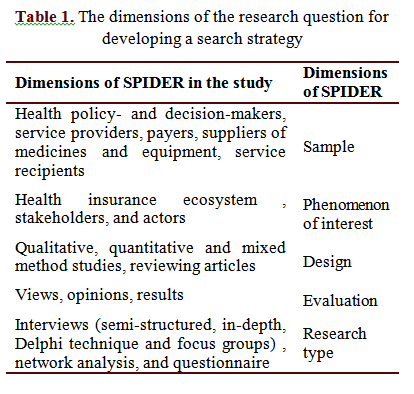

In order to define the dimensions of the research question and develop a search strategy, the Sample, Phenomenon of Interest, Design, Evaluation, Research type (SPIDER) were used. This framework is an effective tool for organizing a search strategy in qualitative and mixedstudies (30). Table 1 presents the SPIDER dimensions included in the present study.

The study was carried outin January 2021. No specific time was determined for the search,and all the retrieved articles were reviewed without considering the publication time. Persian search was conducted in Persian database of Magiran,while English search was performed using related keywords in PubMed, Scopus, Web of Science and Cochrane databases.

In addition, retrospective and futuristic studies wereconducted to complete the searches.In the retrospective search, the list of references included in the study was reviewed, while in the futuristic search, allthe articles referred to after the publication of the articles were reviewed in Google Scholar. In order to find the related articles, the search strategy in databasesbecame limited to title and abstract. The search strategy used in English databases was as follows:

("health insurance"or "medical insurance", and ("ecosystem" or "stakeholder*" or "actor*" or "institutional map*").

Inclusion and exclusion criteria

Studies were included if devised as original qualitative, quantitative and mixed method research, investigating the key elements and stakeholders of the health insurance ecosystem, published in peer-reviewed journals, and written in either Persian or English in all the years. Studies were excluded if is not about key elements and stakeholders of health insurance ecosystem, and devised as conference abstracts, case reports, case series, letters to editor, editorial commentaries, expert opinion, interventional studies and reviews.

Although some researchers believe that it is better to include similar studies in meta-synthesis in terms of method (25, 31), someother researchers believe that using different studies increases depth and scope of description and interpretation of the subject under the study in terms of method. In this case, the power and limitations of various methods are opposed to each other (32, 33).On the other hand, using studies with various methods in meta-synthesis causes the triangulation of meta-synthesis (34). Thus,all types of studies (quantitative, qualitative and mixed method) were included in the present study.

Evaluating the quality of articles and selecting eligible studies to be included in meta-synthesis

At this step, the findings related to each of the searched databases were stored separately in the EndNote X7 software.Duplicate titles were eliminated, the title and abstract of the remaining articles were reviewed according to the exclusion and inclusion criteria, and the relevant articles were separated. After that, the full textswere read, and the relevant studies were completely identified.The initial evaluation of the titles and abstracts of the retrieved studies was conductedby two colleagues from the research group, and in cases of disagreement, a third party would make decisions. The selected articles were reviewed by two members of the study group, and then,their content was elicited.Sincetwo studies were quantitative and eightwere qualitative from the ten studiesincluded inthe quality assessment of thestudies, the Mixed Methods Appraisal Tool (MMAT) evaluation checklist version 2018 was used to evaluate their quality (35), and to control the quality of all the papers, they were re-evaluated by thesecond individual.

Data extraction and combination and code creation

At this step, the selected articles were reviewed one by one, and the details of each paper were reviewed. Then, a summary of the most significant topics of methodology, population, and findings were entered into the tables of systematic review findings. Next, their key concepts and themes were identifiedusing content analysis method.In this approach, the analysis begins from one study, and gradually the synthesis progresses towards the others, and the list of codes becomes more and more complete by addingeach study(32). Finally,the list of actors and key elements of the health insurance ecosystem wasmade from the analysis of preliminary studies. Using deductive approach, the text of each article was carefully read, coded and categorized in MAXQDA 2020software, and then based on the functions of the health system in the 2000 model of the World Health Organization, the codes from the previous stage were placed in the functionpart through inductive approach. In order to create sub codes (subthemes), the two-way interaction and adductive approach were used.The present study was approved by the ethicscommittee of Tehran university of medical sciences(code: IR.TUMS.MMEDICINE.REC.1399.983).

Results

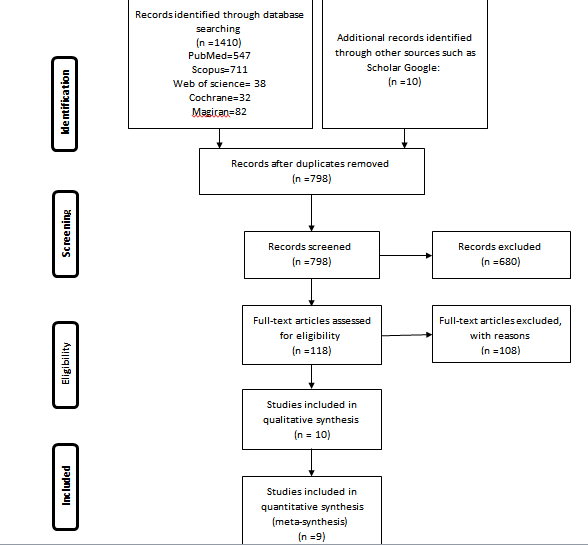

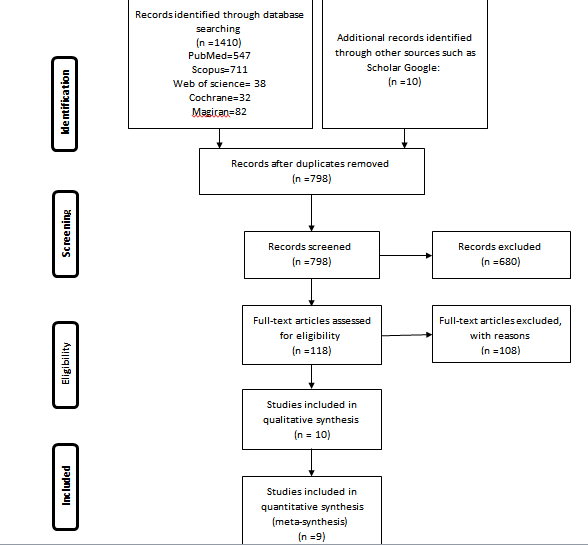

According to the search strategy, 1410 articles were found in the main databases and 10 articles were found by manual search. The studies were entered into EndNote X7 reference software, and 612 duplicate records were eliminated from the search results. After eliminating the duplicate items, the remaining 798 records which were screened with respect to the title and abstract, as well as 680 irrelevant records, were eliminated from the search results. The remaining 118 records were evaluated by reading the full text, of which 108 records were eliminated due to the lack of inclusion criteria. Eventually, ten studies were included in the quality assessment. It should be noted that one paper was excluded from the study after the quality assessment, and nine studies were included in the final analysis. The stages of selecting the studies (PRISMA table) are presented in Figure 1.

Since no time frame was determined for selection of articles, those included in the synthesis were from 1992-2020. Out of nine studies, one was in Persian while eight were in English. Three studies were of mixed type, one paper was quantitative, and five were qualitative. In addition, five studies were conducted in Iran, while others were carried out in Korea, Taiwan, Ghana, and Afghanistan. As can be observed in Table 2, the studies conducted in Iran are more than that of other countries and are in recent years, indicating that Iran has placed greater importance on recognizing the actors of the health insurance ecosystem compared to other countries.

The results of the quality assessment on studies using MMAT checklist indicated that all studies, except for one, have the necessary quality to enter this study. The MMAT assessment checklist consists of two stages. In the first stage, the evaluation begins with 2 questions. "Are the research questions clear? And “Do the collected data answer the research questions?" If the answer to both questions is yes, the evaluation goes to the next stage, and according to the type of study (qualitative, randomized controlled, non-randomized, quantitative descriptive and combined), the researcher will answer questions related to the same type of study. All studies were evaluated in terms of the two questions from the first stage of evaluation, as being qualified to go to the next stage or not, except for one study (36), which did not get a passing score regarding the questions,and did not reach the intended status to enter the second stage of qualitative evaluation and inclusion in the study. Finally, 9 studies entered this study and the meta-synthesis stage.

The number of identified themes in relation to the performances (objectives and values) of the ecosystem was equal to 10. Regarding health insurance ecosystem functions, four main themes and 13 subthemes were identified, and also, 38 institutions and organizations were identified as ecosystem actors. As shown in Table 3,Sohn’s study (37) failed to investigate the functions of ecosystem and in the other studies themes of fair participation for paying premiums, and financial protection of the insured against back-breaking costs and out-of-pocket payments were recognized as ecosystem objectives, mentioned (13, 38-44) and dealt with according to values of quality, justice, access, satisfaction and population coverage. In this study, the functions and actors of the ecosystem were given more emphasis.

The functions identified for health insurance ecosystem as the main themes, were consistent with the functions stated by the WHO in its 2000 report about the health system (2), and involved governance, financing, service delivery, and resource production. In the main code of governance, six subcodes were identified, among which governance and structure of the insurance system were mentioned in most of the studies. Regarding the main theme of financing, the subtheme of service purchase and service provision were mentioned in most researches.

In order to identify the actors of the health insurance ecosystem, since the studies in meta-synthesis stage addressed specific topics such as fund aggregation, service packages, or the health insurance policy process, the actors mentioned in each of these studies were not comprehensive enough as the actors of the whole ecosystem.

Thus, one of the articles (13) which studied the health insurance ecosystem with a more comprehensive approach, compared to other studies, was considered the index article, while the rest of the studies with regard to identifying the actors, were compared with this study. Since this study was conducted in Iran, some of the identified actors were relevant only to the health insurance ecosystem of Iran including Expediency Council, Armed Forces Medical Services Insurance Organization, Supreme Council of Health and Food Security, etc.

Table 5 indicates the names of other actors in the health insurance ecosystem by country in the articles.

As can be seen, the Ministry of Health is one of the actors in the health insurance ecosystem as mentioned in all studies, and known as the main actor of the ecosystem, followed by the Ministry of Labor and Social Welfare and the Ministry of Economic affairs as discussed in most of the studies.

The major part of the health insurance ecosystem (26%) consists of supportive organizations and institutions, followed by executive, supervisory, and legislative roles played by different actors at the ecosystem level known as the key roles in this ecosystem. Meanwhile, the roles such as service providers, the insured and insurers, and drug suppliers have minimum participation in this ecosystem. Among the actors with the role of supervisory governance, an actor such as the medical system was more critical in the role of executive governance in universities, and in the role of financial governance of the Ministry of Economy and the Planning and Budget Organization as investigated in most of the studies.

In recent years, there has been a strong inclination towardsusing ecosystem as a new approachto explain and interpret business environments and systems, such as the health insurance system (14).Business ecosystems as an economic community is the interaction of various organizations, individuals and institutions including different customers, manufacturers, competitors and stakeholders (15) who are interrelated and interdependent (16).Business ecosystem theory is a tool whichdescribes today's business environments systematically,and analyzes the potential effects of various organizations' decision-making on each other in a network (17).Thus, policy makers and planners of differentareas such as health should expand their knowledge of ecosystem analysis before planning and implementing any reform in the financing system and health insurance. In addition, they should gain knowledge on the elements of health insurance ecosystem and the relationships between them toappropriately respond to changes in this ecosystem (18).

Although many studies have been conducted in different countries on health system reforms,financing system, and health insurance (19-24), no study has comprehensively analyzed the elements of this field with an ecosystem approach. Since meta-synthesis studies are valuable for a comprehensive knowledge and deep understandingregarding the phenomenon under study, and help to make decisions based on scientific evidence and the research findings (25,26), the systematic review and meta-synthesis method were used to explain the key elements (objectives, values, performances and functions) and actors of the health insurance ecosystem.This paper was part of another study aiming to design the health insurance ecosystem.

In this study, an effort was made to answer the following key questions: Who are the actors in health insurance ecosystem? What are the objectives of the health insurance ecosystem? What are the values of the health insurance ecosystem? What are the functions of the ecosystem treatment?

Materials and Methods

Systematic review studies aim to identify, evaluate, and summarize the findings of separate studies related to a specificsubject, and facilitate access to existing evidence for policy makers (27).Meta-synthesis attempts to integrate the results of different but related qualitative studies. This technique, unlike meta-analysis of quantitative studies, is assumed to be interpreted rather than aggregated. Qualitative meta- synthesis is defined as theories, macro-narratives, generalizations, or interpretive translations that result from integration or comparison of the findings of qualitative studies(28).This study aimed to investigate the key elements and actors of the health insurance ecosystem, and analyze and combine the findings of the systematic review in the form of meta-synthesis using the six-step Walsh and Downetechnique (29).

Search strategy

In order to define the dimensions of the research question and develop a search strategy, the Sample, Phenomenon of Interest, Design, Evaluation, Research type (SPIDER) were used. This framework is an effective tool for organizing a search strategy in qualitative and mixedstudies (30). Table 1 presents the SPIDER dimensions included in the present study.

The study was carried outin January 2021. No specific time was determined for the search,and all the retrieved articles were reviewed without considering the publication time. Persian search was conducted in Persian database of Magiran,while English search was performed using related keywords in PubMed, Scopus, Web of Science and Cochrane databases.

In addition, retrospective and futuristic studies wereconducted to complete the searches.In the retrospective search, the list of references included in the study was reviewed, while in the futuristic search, allthe articles referred to after the publication of the articles were reviewed in Google Scholar. In order to find the related articles, the search strategy in databasesbecame limited to title and abstract. The search strategy used in English databases was as follows:

("health insurance"or "medical insurance", and ("ecosystem" or "stakeholder*" or "actor*" or "institutional map*").

Inclusion and exclusion criteria

Studies were included if devised as original qualitative, quantitative and mixed method research, investigating the key elements and stakeholders of the health insurance ecosystem, published in peer-reviewed journals, and written in either Persian or English in all the years. Studies were excluded if is not about key elements and stakeholders of health insurance ecosystem, and devised as conference abstracts, case reports, case series, letters to editor, editorial commentaries, expert opinion, interventional studies and reviews.

Although some researchers believe that it is better to include similar studies in meta-synthesis in terms of method (25, 31), someother researchers believe that using different studies increases depth and scope of description and interpretation of the subject under the study in terms of method. In this case, the power and limitations of various methods are opposed to each other (32, 33).On the other hand, using studies with various methods in meta-synthesis causes the triangulation of meta-synthesis (34). Thus,all types of studies (quantitative, qualitative and mixed method) were included in the present study.

Evaluating the quality of articles and selecting eligible studies to be included in meta-synthesis

At this step, the findings related to each of the searched databases were stored separately in the EndNote X7 software.Duplicate titles were eliminated, the title and abstract of the remaining articles were reviewed according to the exclusion and inclusion criteria, and the relevant articles were separated. After that, the full textswere read, and the relevant studies were completely identified.The initial evaluation of the titles and abstracts of the retrieved studies was conductedby two colleagues from the research group, and in cases of disagreement, a third party would make decisions. The selected articles were reviewed by two members of the study group, and then,their content was elicited.Sincetwo studies were quantitative and eightwere qualitative from the ten studiesincluded inthe quality assessment of thestudies, the Mixed Methods Appraisal Tool (MMAT) evaluation checklist version 2018 was used to evaluate their quality (35), and to control the quality of all the papers, they were re-evaluated by thesecond individual.

Data extraction and combination and code creation

At this step, the selected articles were reviewed one by one, and the details of each paper were reviewed. Then, a summary of the most significant topics of methodology, population, and findings were entered into the tables of systematic review findings. Next, their key concepts and themes were identifiedusing content analysis method.In this approach, the analysis begins from one study, and gradually the synthesis progresses towards the others, and the list of codes becomes more and more complete by addingeach study(32). Finally,the list of actors and key elements of the health insurance ecosystem wasmade from the analysis of preliminary studies. Using deductive approach, the text of each article was carefully read, coded and categorized in MAXQDA 2020software, and then based on the functions of the health system in the 2000 model of the World Health Organization, the codes from the previous stage were placed in the functionpart through inductive approach. In order to create sub codes (subthemes), the two-way interaction and adductive approach were used.The present study was approved by the ethicscommittee of Tehran university of medical sciences(code: IR.TUMS.MMEDICINE.REC.1399.983).

Results

Since no time frame was determined for selection of articles, those included in the synthesis were from 1992-2020. Out of nine studies, one was in Persian while eight were in English. Three studies were of mixed type, one paper was quantitative, and five were qualitative. In addition, five studies were conducted in Iran, while others were carried out in Korea, Taiwan, Ghana, and Afghanistan. As can be observed in Table 2, the studies conducted in Iran are more than that of other countries and are in recent years, indicating that Iran has placed greater importance on recognizing the actors of the health insurance ecosystem compared to other countries.

The results of the quality assessment on studies using MMAT checklist indicated that all studies, except for one, have the necessary quality to enter this study. The MMAT assessment checklist consists of two stages. In the first stage, the evaluation begins with 2 questions. "Are the research questions clear? And “Do the collected data answer the research questions?" If the answer to both questions is yes, the evaluation goes to the next stage, and according to the type of study (qualitative, randomized controlled, non-randomized, quantitative descriptive and combined), the researcher will answer questions related to the same type of study. All studies were evaluated in terms of the two questions from the first stage of evaluation, as being qualified to go to the next stage or not, except for one study (36), which did not get a passing score regarding the questions,and did not reach the intended status to enter the second stage of qualitative evaluation and inclusion in the study. Finally, 9 studies entered this study and the meta-synthesis stage.

The number of identified themes in relation to the performances (objectives and values) of the ecosystem was equal to 10. Regarding health insurance ecosystem functions, four main themes and 13 subthemes were identified, and also, 38 institutions and organizations were identified as ecosystem actors. As shown in Table 3,Sohn’s study (37) failed to investigate the functions of ecosystem and in the other studies themes of fair participation for paying premiums, and financial protection of the insured against back-breaking costs and out-of-pocket payments were recognized as ecosystem objectives, mentioned (13, 38-44) and dealt with according to values of quality, justice, access, satisfaction and population coverage. In this study, the functions and actors of the ecosystem were given more emphasis.

The functions identified for health insurance ecosystem as the main themes, were consistent with the functions stated by the WHO in its 2000 report about the health system (2), and involved governance, financing, service delivery, and resource production. In the main code of governance, six subcodes were identified, among which governance and structure of the insurance system were mentioned in most of the studies. Regarding the main theme of financing, the subtheme of service purchase and service provision were mentioned in most researches.

In order to identify the actors of the health insurance ecosystem, since the studies in meta-synthesis stage addressed specific topics such as fund aggregation, service packages, or the health insurance policy process, the actors mentioned in each of these studies were not comprehensive enough as the actors of the whole ecosystem.

Thus, one of the articles (13) which studied the health insurance ecosystem with a more comprehensive approach, compared to other studies, was considered the index article, while the rest of the studies with regard to identifying the actors, were compared with this study. Since this study was conducted in Iran, some of the identified actors were relevant only to the health insurance ecosystem of Iran including Expediency Council, Armed Forces Medical Services Insurance Organization, Supreme Council of Health and Food Security, etc.

Table 5 indicates the names of other actors in the health insurance ecosystem by country in the articles.

As can be seen, the Ministry of Health is one of the actors in the health insurance ecosystem as mentioned in all studies, and known as the main actor of the ecosystem, followed by the Ministry of Labor and Social Welfare and the Ministry of Economic affairs as discussed in most of the studies.

The major part of the health insurance ecosystem (26%) consists of supportive organizations and institutions, followed by executive, supervisory, and legislative roles played by different actors at the ecosystem level known as the key roles in this ecosystem. Meanwhile, the roles such as service providers, the insured and insurers, and drug suppliers have minimum participation in this ecosystem. Among the actors with the role of supervisory governance, an actor such as the medical system was more critical in the role of executive governance in universities, and in the role of financial governance of the Ministry of Economy and the Planning and Budget Organization as investigated in most of the studies.

Table 2. Characteristics of the included studies

| ID | First author and reference |

Year of publication | Location (country) | Language | Data collection method | Analysis method |

Study design | Population. (participant) |

| 1 | Sohn (37) | 1992 | Korea | English | Interview, consultation with informants and official records review | Network analysis | Mixed method | 49 participants from government group and non-government group (political) |

| 2 | Lin (38) | 2010 | Taiwan | English | A semi-structured questionnaire and consultations with experts | Conceptual framework analysis and network analysis | Mixed method | 52 elites and key policy makers |

| 3 | Abiiro(39) | 2013 | Ghana | English | Face-to-face interviews, focus group discussions and a review of media reports | Thematic analysis | Qualitative | 28Key informant interviews and six focus group, discussions with key stakeholders |

| 4 | Zeng(40) | 2017 | Afghanistan | English | Focus group discussions and interviews | Content analysis | Qualitative | 11 stakeholder groups for the key informant, and five stakeholder groups for participation in FGDs |

| 5 | Mohamadi(41) | 2018 | Iran | English | Semi-structured interviews, document analysis, and participation in decision-making meetings |

Content analysis | Qualitative | 23stakeholders were identified and categorized in 6 groups, including policy makers, service providers, payers,suppliers of medicines and equipment, service recipients, and others. |

| 6 | Heydari(13) | 2018 | Iran | English | Semi‑structured and structured interviews |

KammiSchmeer 's stakeholder analysis | Mixed method | A total of 34 Stakeholders were identified who were involved in nine main activities of health insurance |

| 7 | Kavosi(42) | 2019 | Iran | Persian | Questionnaire | Exploratory factor analysis | Quantitative | 170 experts from supportive organizations |

| 8 | Bazyar (43) | 2019 | Iran | English | Semi‐structured face‐to‐face interviews | Stakeholder analysis | Qualitative | Sixty-seven policy actors and players of health insurance system |

| 9 | Bazyar (44) | 2020 | Iran | English | Face-To-Face interviews and documentary review | Content analysis | Qualitative | Sixty top managers and key policy actors |

Table 3. Performances (objectives and values) of the health insurance ecosystem

| Objectives and values | Factors affecting organizations affiliated with Iran's supportive health insurance system | Assessing the feasibility of introducing health insurance in Afghanistan | Network analysis of Korean health insurance policy-making process | Stakeholders analysis of health insurance benefit package policy in Iran | Political feasibility analysis of the new financing scheme for the national health insurance reform in Taiwan | Stakeholder analysis of Iran's health insurance system | What are the potential advantages and disadvantages of merging health insurance funds? | Stakeholders' analysis of merging social health insurance funds in Iran | Universal financial protection through national health insurance |

| Increase of fair participation in financing | * | * | * | * | * | * | |||

| Increase of financial protection | * | * | * | * | * | * | |||

| Decrease of catastrophic health expenditure | * | * | * | * | |||||

| Decrease of out-of-pocket payments | * | * | * | * | * | * | |||

| Increase of expense coverage | * | * | |||||||

| Increase of health services quality | * | * | * | * | * | * | |||

| Increase of population coverage | * | * | * | * | * | * | * | ||

| Increase of justice in health service utilization | * | * | * | * | * | * | |||

| Increase of access to health care services | * | * | |||||||

| Increase of the insured people's satisfaction | * | * |

Table 4.Functions of the Health Insurance Ecosystem Identified in the Systematic Review of Studies

| Main themes | Themes | Subthemes | Ref. |

| Governance | Leadership | Conflict of interest | (41,43) |

| Political and governance commitments | (40) | ||

| Lobbying and influence | (40) | ||

| Identification and analysis of stakeholders | (41) | ||

| Policymaking | Planning and implementation | (13,37,42) | |

| Evidence-based decision making | (41) | ||

| Guidelines | (41,44) | ||

| Health technology assessment | (41) | ||

| Legislation | Passing a law | (40) | |

| Clarification of rules | (40) | ||

| Enforcement of rules | (39,40) | ||

| Structure of health insurance system | Flexibility of structures | (37,44) | |

| Parallel work and overlapping tasks | (13) | ||

| Integration of insurance funds | (13,43,44) | ||

| Purchaser/ provider split | (13,43) | ||

| Intersectoral communication and cooperation | Cooperation and participation | (13,40,43) | |

| Information and negotiation interactions | (37,41) | ||

| Coordinating councils and committees | (42) | ||

| Competition | (13,42,44) | ||

| Resistance to change | (43) | ||

| Monitoring, control and evaluation | Monitoring reference | (42,44) | |

| Service evaluation | (13,40) | ||

| Moral hazards and abuse | (13,44) | ||

| Financing | Resource collection | Funding allocation | (44) |

| Determining and approving of the premium | (38,39,42-44) | ||

| Receiving and paying premiums | (13,38-40,42-44) | ||

| Public and international aid (charity) | (40) | ||

| Providing sustainable resources | (13) | ||

| Taxation | (38-40,42) | ||

| Government subsidies for premiums | (38,42,44) | ||

| deductible payment | (42) | ||

| Revenue management | Risk accumulation and distribution | (13,40,42-44) | |

| Purchase of services | Tariffs | (13,42-44) | |

| Multi-tariff services | (43) | ||

| Payment system for providers | (13,40,42,44) | ||

| Strategic purchasing | (13,43,44) | ||

| Balance between resources (revenue) and expenditures (costs) | (38,41,43,44) | ||

| Service delivery | Healthcare service | Health Improvement | (40,42) |

| Family physician and referral system | (44) | ||

| Package and coverage services | (13,37,38,40-44) | ||

| Service stratification | (41) | ||

| Insurance services | Signing a contract | (38,42) | |

| Supporting services | (13) | ||

| Health insurancecoverage duplication | (43,44) | ||

| Resource production | Human resources | Lack of executive capabilities and capacities | (40) |

| Information resources | Transparency and information system integration | (43,44) |

Table 5.The actors identified in the systematic review by studies

| Role | The name of health insuranceecosystem actors in the countries under the study | ||||

| Iran (13,41-44) | Afghanistan(40) | South Korea(37) | Ghana (39) | Taiwan(38) | |

| Policy-making governance | Ministry of Health and Medical Education (MOHME) | Ministry of Public Health | Ministry of Health and Social Affairs | Ministry of Health | Department of Health |

| Ministry of Cooperative Labor and Social Welfare (MCLSW) | Ministry of Labor and Social Affairs [MOLSA] | Ministry of Health and Social Affairs | - | Council of Labor Affairs | |

| Government | - | - | - | Government | |

| Regulatory governance | Central Insurance of I.R. Iran | - | - | - | - |

| Legal Medicine Organization | - | - | - | - | |

| Nursing Council | - | - | - | - | |

| Iran Medical Council | - | Korean Medical Association | - | Taiwan Medical Association | |

| Iran Expediency Council | - | - | - | - | |

| Financial governance | Management and Planning Organization (MPO) | - | Ministryof Economic Planning Board | - | Directorate General of Budget |

| Ministry of Economic Affairs and Finance | Health Economics and Financing Directorate (HEFD) | Ministry of Finance | - | Ministry of Economic Affairs | |

| Target organization for subsidies | - | - | - | - | |

| Executive governance | Universities of medical sciences | - | Public health universities | Academics | - |

| Governors / mayors /district governors | - | - | - | - | |

| Food and Drug Administration | - | Bureau of Pharmaceutical Affairs | - | - | |

| President | - | president | - | - | |

| Legislative governance | Supreme Council of Health Insurance | - | National Health Insurance'soperating committee | - | - |

| Health Commission Parliament of Islamic Republic of Iran (HCPI) | Parliament | - | Parliament | - | |

| Coordination council of basic insurance organizations | - | - | - | - | |

| Supreme Council for Health Policy Making | - | - | - | ||

| Supporting Organizations and Institutions | Patient protection associations | - | - | - | - |

| International Organizations | International donors and organizations | - | - | - | |

| Community Pharmacists Association, Society of Radiology, Pharmacists Association, Association of General Practitioners, Laboratories Association | - | Korean Midwife Association, Korean Dental Association, Korean Pharmaceutical Association, Korean Hospital Association, Korean Medical Association | - | Medical Associations, theNational :union: of Pharmacist Associations, China Dental Association, the National :union: of Chinese Medical Doctors’ Associations | |

| Board of Medical specialties | - | - | - | - | |

| Imam Khomeini Relief Foundation | - | - | - | - | |

| Welfare organization | - | - | - | Welfare groups | |

| Red Crescent Organization | - | - | - | - | |

| NGO | - | NGO | - | (NGOs) of Taiwan | |

| The Organization of prisons | - | - | - | - | |

| Martyr Foundation | - | - | - | - | |

| Insuranceorganizations | Iran Health Insurance Organization | - | Bureau of Health Insurance | - | Bureau of National Health Insurance |

| Armed Forces Medical Insurance Organization | - | - | - | - | |

| Social Security Organization | - | Bureau of Social Insurance | - | - | |

| Oil And Banks Companies | - | - | - | - | |

| Private Insurance Organizations | Private Insurance Companies | - | - | - | |

| Insurer | Immigration And foreign affairs of the Ministry of Interior, Ministry of Education | Ministry of Justice | - | - | Ministry of the Interior, Ministry of Civil Service |

| Providers | Physicians and other health service providers | Public hospital, private hospital | - | Clinical health workers | Private pharmacist |

| Suppliers | Suppliers of medicines and equipment | - | - | - | - |

| Insured | People and households | - | - | - | People |

Figure 1. The process of selection of studies

Discussion

The health insurance ecosystem involves all the organizations and institutions who act in this field based on its objectives, values and functions. A comprehensive understanding of the elements (performances and functions) and actors of this ecosystem can be effective in improving its current status and in the future.

The findings of the present study indicated that the most important objective of the health insurance ecosystem is creating a fair participation in financing and financial protection of the insured, which is done based on the values such as quality, justice, access, satisfaction, and population coverage. The most important functions of the ecosystem are governance, financing, service delivery, and resource production, while the Ministry of Health and Welfare is the key actor in the ecosystem. In some countries such as Korea, these two ministries work under one ministry. The key point is that there is a close relationship between the functions and performances of this ecosystem, and it is not often separable. In addition, the positive or negative results of each can directly or indirectly influence one another. Even the actors affect the functions and performances of the ecosystem, either in terms of the role of the actor, or the combination of the roles of actors and the relationships between them. Then, the objectives, values, functions, and actors of the ecosystem were discussed in detail.

Objectives and values of the health insurance ecosystem

The most significant objective of the health insurance ecosystem is to create financial protection and fair participation in financing, in line with the universal health coverage. Since financing a major part of the health system in many countries is conducted through the insurance system, insurance organizations play a key role in achieving the objectives of the health system, especially health promotion and fair financial participation (2), so that using policies such as population coverage and expenses coverage of services by insurance organizations help the implementation of a fair participation in financing (41).

Financial protection of people against health costs, along with the improvement of public health, as well as responding to people's expectations are known as the objectives of the health system, and is among the consequences of establishing prepayment mechanisms regarding public health coverage (40, 45). Efforts to establish fair systems, executive guarantees for access to high-quality health care services, and financial protection of everyone in society are among the most serious challenges for the health systems, especially in developing countries (4). Lack of financial protection is considered a disease of health insurance ecosystems, a clear indication of which is that households would suffer not only from the burden of disease, but also from the burden of poverty and economic hardship due to the debilitating costs of their health (24). Despite governments' efforts to provide financial protection for individuals, they may not be able to create such conditions (40).

Functions of health insurance ecosystem

In the national health insurance ecosystem of many countries, in addition to taxing the salaries of employees and employers (38), the government takes a percentage of premiums as subsidy. In some countries such as Iran, where the government subsidies are derived from the sale of crude oil and are subject to fluctuations with respect to the world oil prices, they are regarded as an unsustainable source. For this reason, it is better for sustainable sources such as taxes (income tax, value-added tax) to form a larger share of the financial resources in the health insurance ecosystem (46).

Tariff is regarded as one of the most significant tools of health and insurance system's policy makers in any country which is effective respecting justice, efficiency, quality and accountability in service delivery, and can affect the level of access and use of services (47). Tariff in the health insurance ecosystem is associated with some challenges such as unrealistic tariffs, lack of up-to-date tariffs, and multi-tariff services in the public and private sectors (48). If the service tariff is not real and there is fragmentation in the insurance system, it will be impossible to make strategic purchases in a real way in the health insurance ecosystem (44).

In recent years, the service package defined for the insured in the ecosystem has been developed extensively without reviewing, while the increase in the income of the insurance companies (increase in premiums) has not been in line with it, leading to incompatibility between budget, premium per capita, and financing of service package by insurance organizations (41). Lack of balance between income and expenses of the insurance organizations, as well as the need for cost management, have been investigated in several studies (38, 43, 44). In particular, the development of prevention and health service coverage such as referral systems based on family physician programs in some countries is the primary key for health policy makers and planners to achieve the objectives of the health insurance ecosystem. Factors such as long-term debts and non-timely repayment of insurance organizations to prevention services are considered major challenges for the development of insurance services (49). In addition to the development of the covered services, one of the values mentioned in the studies (38, 39, 43, 44) is the quality of services, which is a significant precondition for the introduction of a health insurance ecosystem (40).

Another function of the health insurance ecosystem is its governance. In this field, the subjects such as conflict of interest, insurance structures, and the multiplicity of insurance funds are the issues addressed in further studies. Conflict of interest is considered a serious challenge in health systems. One of the factors leading to the conflict of interest is the presence of insurance funds and organizations with various and specific structures and laws (43). Furthermore, another challenge related to the structure of the insurance system in the health insurance ecosystem is the conflict of interest in relation to the role of actors in the ecosystem. For instance, if the role of buyer (insurer) and provider is played by an actor from the ecosystem, it will create a conflict of interest and prevent the implementation of strategic purchases (21), or a conflict of interest will occur when physicians take on governance roles in addition to playing the role of provider (43).

The presence of multiple insurance funds leads to many challenges in the health insurance ecosystem, which have been addressed in this and other studies. For example, lack of information transparency, inability to plan appropriately due to the differences in revenues and costs of different insurance funds, difference in levels and types of commitments, services approved by insurance organizations in the health insurance ecosystem, impossibility of supervision on services provided by insurance organizations and multiple insurance funds, and differences in the types of services provided to individuals (44, 50). By accumulating, combining, and integrating different funds and organizations in a single structure, premiums can be reduced after subtracting the organizational costs and funds (44). Thus, different countries have implemented health financing by establishing a single organization or insurance fund to strengthen risk accumulation, financial protection, and improve equality and efficiency, which is accompanied by great political resistance. Interactive policies can be applied to improve the relationships and interactions between relevant actors. This issue should be dealt with by actors with executive roles in the health insurance ecosystem (46, 51).

Actors of the health insurance ecosystem

Actors are considered another key element of any ecosystem, and it would be impossible to make any reforms to the health insurance ecosystem without appropriately identifying and analyzing the role and effect of the actors. In studies conducted in Turkey and Afghanistan to evaluate the effect of reforms on the health system and the implementation of new reforms, the related actors were identified and analyzed in terms of strength, influence, and effectiveness (20, 52). In this way, policy makers and managers can implement the desired reforms, policies and programs in a desirable and effective manner (39).

In all the papers, the Ministry of Health was regarded as an actor in the health insurance ecosystem, followed by the Ministry of Welfare as the main actor. Some of the studies revealed the significance and effect of the Ministry of Health in using policies and strategic planning at the national level and their implementation at the regional level (37, 42). The Ministry of Health, as the custodian of the health system, has great power and a supportive role in the health insurance ecosystem (13, 41). Therefore, it seeks to respond and provide higher access to health services for individuals, while the Ministry of Cooperatives, Labor and Social Welfare deals with the balance of resources and the costs of health insurance organizations (41). The analysis of communication network between the key actors with executive roles regarding policy-making in the health insurance ecosystem indicated that the Ministry of Health and Health Insurance Organization play a major role in the policy-making network (38).

In some countries such as Korea, the two Ministries of Health and Welfare are considered under one entity. In a country like Iran, since the health insurance mechanism is under two Ministries of Health and the Ministry of Welfare, participatory and coordinating structures such as the Supreme Council of Health Insurance and the Coordination Council of Basic Insurance Organizations have been established to play the role of legislative governance and regulator as intermediary structures. In the health insurance ecosystem, a role such as the insured has been generally defined as the individuals covered by insurance services, including a wide range of people such as employees, workers, villagers, and vulnerable people. In terms of frequency, compared with other roles, the insured forms a large part of the health insurance ecosystem. Since this role is played by only one actor, it had little effect, and it was seen that studies have not considered it an ecosystem actor (37, 39, 40). Almost half of the health insurance ecosystem involves a variety of governance roles such as regulatory, legislative, policy-making, and financial, indicating their significance and effect on the health insurance ecosystem. The role of supporting organizations and institutions with the most actors, have become more highlighted in the countries which face the lack of budget for insurance organizations, and have increased the role of supporting organizations and institutions such as associations and international organizations (13, 37, 38, 40).

The separation of the buyer from the provider is defined as a measure in which the buyer, as someone who makes decisions about what services should be provided by the provider, is separated from the provider who should provide services and agreed outputs (53). Due to the structural differences between health systems in various countries, it is difficult to compare and evaluate the effects of this separation on the health system (54, 55) and scientific evidence, as well as different and controversial results on the effects of buyer and provider separation on the values such as increasing efficiency and improving the service quality (56, 57). It is suggested to do this separation due to the numerous and controversial discussions which exist in this field in the health insurance system of Iran.

Although many studies have evaluated the actors related to issues such as service packages, fund aggregation, insurance plans, etc. in the insurance ecosystem through a stakeholder analysis approach, no study has investigated the key elements and actors with a comprehensive approach. Therefore, the present study aimed to fill this research gap. One of the limitations of this study was that although no specific limitation in terms of time (year) and location (country) was considered in the search strategy, the studies on health insurance ecosystem, which were discovered and entered into the research and meta-synthesis, involved only middle-income countries. More than half of the studies considered Iran in a mixed insurance structure (basic and supplementary insurance with multiple structures and funds), and the countries which had a national medicine system and a single insurance system and faced fewer challenges in the health insurance ecosystem, were not included in the present study.

Conclusion

The findings of this study, presented in the form of performances (objectives and values), functions, and actors of the health insurance ecosystem, indicated that fair participation and financial protection as the objectives of the health insurance ecosystem is realized through the ecosystem functions of governance, resource provision, and service delivery in the context of an integrated and transparent structure. Governance as the most significant role of the ecosystem, whose actors with various levels of governance half of the ecosystem roles, divides different roles and tasks among the actors. In addition, it encourages the required participation and coordination and regulates interactions between actors with different roles through the mechanisms such as tariffs and payment system. The presence of too many actors with different roles or different roles played by an actor in the ecosystem may result in complexity and conflict of interest.

Implementing reforms in financing and insurance system of countries entails great significance and high priority, and an emphasis on adding prevention and health-oriented services to the service package. This has created a unified insurance system to optimize risk accumulation and distribution to increase the financial protection of individuals during the recent years.

Based on the results of the present study, the actors such as the Ministry of Health in every country are known as the most important actors in the health insurance ecosystem along with other actors such as the Ministry of Welfare and Economy. In order to reduce the complexity and multiplicity of the roles of an actor, the other actors in the governance of the ecosystem such as financial, regulatory, and legislative governance are required to play a role in line with the structure of each country.

The results of the present study help health insurance policy makers to recognize key actors in the health insurance ecosystem and make the required modifications by focusing on their power, role, and influence on other actors and the ecosystem functions.

Acknowledgements

Non applicable.

Conflict of interests

The authors declared no conflict of interests.

Authors' contributions

Noori Hekmat S, Rahimisadegh R, Mmehrolhasani MH, and Jafari sirizi M designed research; Noori Hekmat S, Mmehrolhasani MH, and Jafari sirizi M conducted research; Rahimisadegh R, Mmehrolhasani MH analyzed data; and Rahimisadegh R and Mmehrolhasani MH wrote the paper. All authors read and approved the final manuscript.

Funding

Non applicable.

Type of Study: Original article |

Subject:

Healt care Management

Received: 2021/10/18 | Accepted: 2022/01/30 | Published: 2022/03/29

Received: 2021/10/18 | Accepted: 2022/01/30 | Published: 2022/03/29

Send email to the article author

| Rights and permissions | |

|

This work is licensed under a Creative Commons Attribution-NonCommercial 4.0 International License. |