Volume 6, Issue 3 (10-2022)

EBHPME 2022, 6(3): 169-187 |

Back to browse issues page

Download citation:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

BibTeX | RIS | EndNote | Medlars | ProCite | Reference Manager | RefWorks

Send citation to:

Ansari M, Takian A, Yazdi-Feyzabadi V. The Challenges of Iran's Pharmaceutical Export: A Qualitative Content Analysis. EBHPME 2022; 6 (3) :169-187

URL: http://jebhpme.ssu.ac.ir/article-1-400-en.html

URL: http://jebhpme.ssu.ac.ir/article-1-400-en.html

Department of Health Management, Policy and Economics, Faculty of Management and Medical Information Sciences, Kerman University of Medical Sciences, Kerman, Iran , va_yazdi@kmu.ac.ir

Full-Text [PDF 880 kb]

(1799 Downloads)

| Abstract (HTML) (1808 Views)

Full-Text: (542 Views)

Background: Development of non-oil exports, including pharmaceutical products is one of the most important economic development strategies. This study aims to explain challenges of pharmaceutical export in Iran by using the sources and content of online media news.

Methods: This was a qualitative study which analyzed the content of general and specialized online media news in Iran (conventional approach) from January 20, 2017 to January 20, 2020. Data sources were selected using the purposive sampling method .Then, the eligible news was determined by quota sampling method and was inductively analyzed in MAXQDA10.

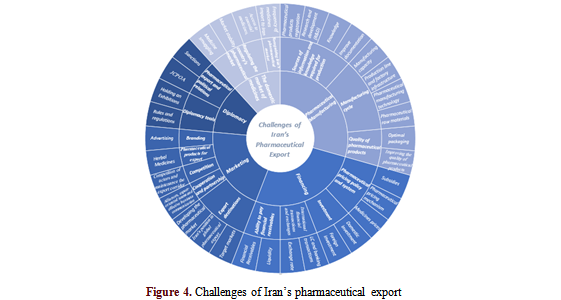

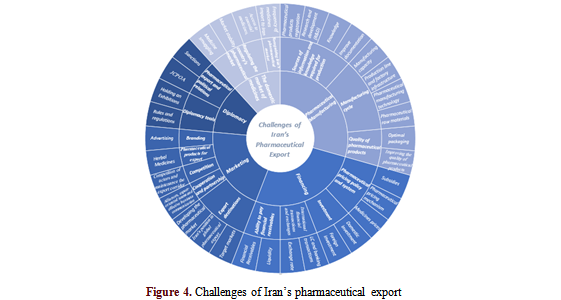

Results: The identified challenges were divided into five main categories including the domestic market of medicines, pharmaceutical manufacturing, financing, marketing and diplomacy. The most important challenges were related to financing and marketing.

Conclusion: Iran's position regarding worldwide export of drugs is not satisfactory. The target markets for drug exports should be developed using a national economic program and appropriate diplomacy, in addition to improving the quality of drug production.

Key words: Challenge, Export, Pharmaceutical, Media analysis, Iran.

Introduction

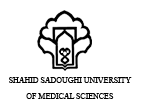

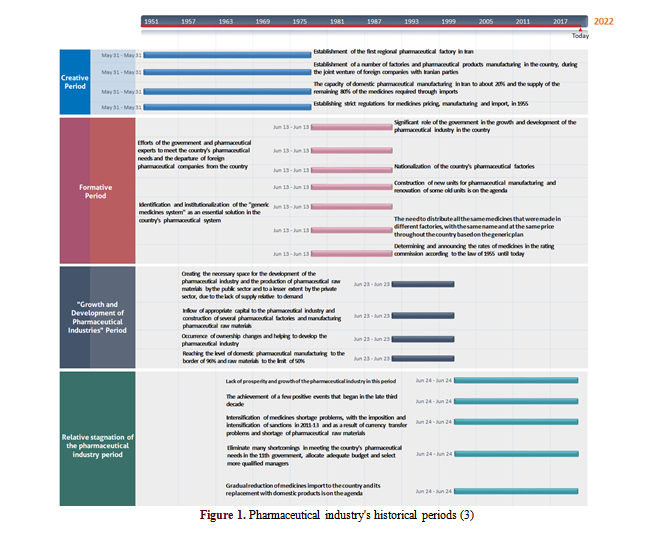

Pharmaceutical industry is one of the top five industries in the global economy (1). International medicine exports amounted to $ 680 billion in 2020 (2). This is while Iran, with US$ 96 million in pharmaceutical export, accounted for a small share (0 %) of the international pharmaceutical exports and ranked the 76th (2). Based on the timeline and despite the establishment of pharmaceutical factories, nationalization of the industry, implentation of a comprehensive plan, and investment in the sector, Iran's pharmaceutical industry is still struggling. Due to sanctions, Iran’s pharmaceutical industry has been unable to obtain raw materials and has had difficulties with currency transfers and financial transactions. Moreover, Iran could not take advantage of pharmaceutical factories and facilities available for the production and export of pharmaceutical goods. The evolution of Iran's pharmaceutical industry is shown in a timeline (Figure 1) (3).

Studies have shown that as the global monopoly of exporters decreases, the import seeks monopoly in the competition (4). Iran has a small share of the world's pharmaceutical exports (5). The structure of Iran's pharmaceutical exports has been moving towards opening multiple monopolies (4). In addition, some studies have identified the barriers to market access including import restrictions and intellectual property protection, price control laws, access to foreign exchange policy, certificate of non-production, and government's purchase and participation to develop production (6). Another study identified India as one of the largest suppliers of medicines to Nigeria at low prices (7).

Iran's strategic position in West Asia provides an excellent opportunity for the country to enter other countries' health system through pharmaceutical exports and currency inflows into Iran. Furthermore, according to the Millennium Development Goals (MDGs) and the Sustainable Development Goals (SDGs) (8, 9), as well as the emphasis of the country's upstream documents (10-13), the development of pharmaceutical exports appears as one of the economic development strategies (4, 14). Therefore, this study aims to explain the challenges in Iran’s pharmaceutical industry with focus on export through the media analysis approach.

Materials and Methods

Study design

The most important online news sources were specified using purposive sampling. They included general and specialized press agencies and sites selected through quota sampling.

The inclusion criteria for the selection of online media news resources were as follows:

• News sources with non-Persian languages

• News published locally

• News unrelated to "drug export"

• News published about pharmaceutical export in other countries

• News items that had not been released within the studied period.

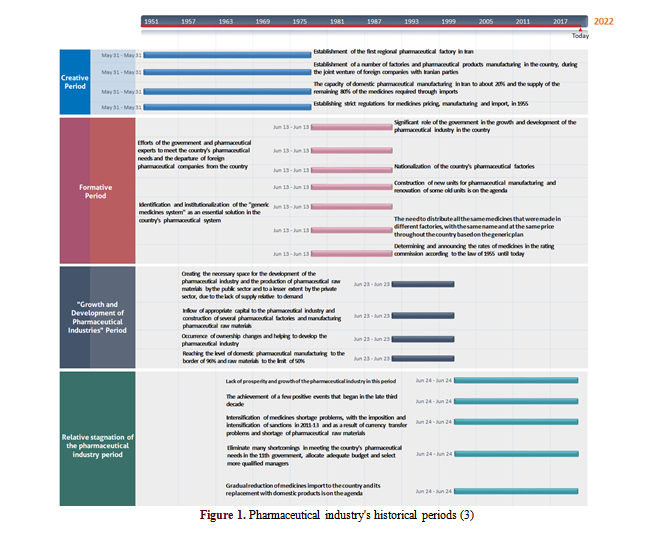

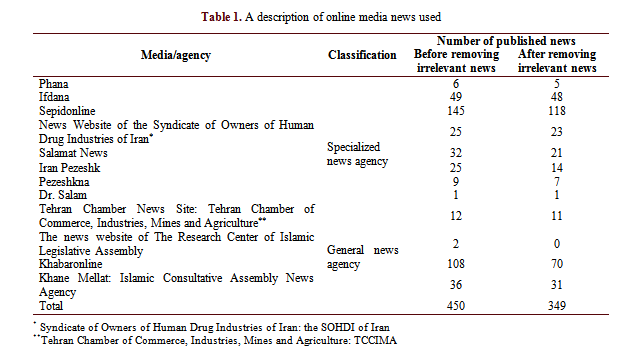

A description of these news outlets is shown in Table 1.

Search and keywords

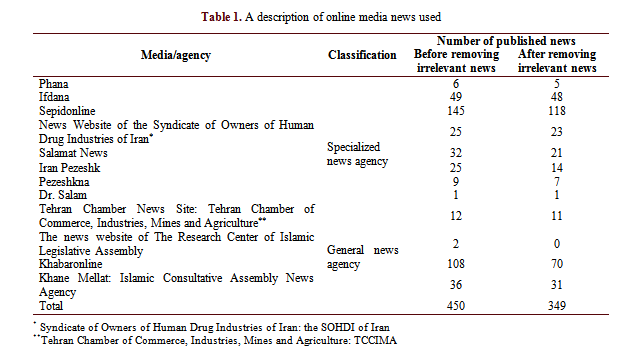

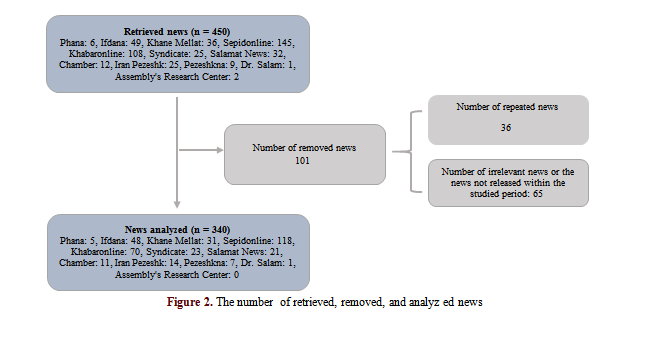

Data were collected by searching the keywords "medicine", "Pharmaceutical Products", Export", and "Iran" in Persian in the news sources from January 20, 2017, to January 20, 2020. The retrieved, removed, and analyzed news are shown in Figure 2.

Table 2. The identified and extracted categories, subcategories and codes

* Research and development: R and D

** Letter of Credit: LC

*** Joint Comprehensive Plan of Action: JCPOA.PNG)

Discussion

Pharmaceutical industry has a lot of potential for economic development, including high financial turnover and currency inflow into the country. To this end, having a competitive advantage, improving R and D initiatives and the position of countries in international markets are among the factors facilitating the survival of governments in global pharmaceutical markets. This study examined challenges of pharmaceutical export in Iran by using the sources and content of online media news . The most critical challenges in this study in order of importance and frequency were financing issues, marketing, pharmaceutical manufacturing, diplomacy, and the domestic market of medicines, respectively.

The main financing challenges identified in this study were exchange rate fluctuations, improper pricing, non-payment of financial receivables and the resulting liquidity decline. On the other hand, exchange rate fluctuations had a significant impact on the liquidity of pharmaceutical companies. The present study showed that non-payment of pharmaceutical companies' financial receivables by hospitals and pharmacies due to non-payment by insurance organizations is one of the challenges of Iran's pharmaceutical industry. This leads to a reduction in the liquidity of companies. In addition, there is the scarcity of liquidity, the impossibility of opening LC accounts for purchase of pharmaceutical raw materials, and the obligation to pay the total price of the purchase to disrupt the process of raw material supply. Subsequently, pharmaceutical manufacturing undermines the development of drug market and export capacity. Compared to the pricing of imported medicines, which is based on the purchase invoice from foreign companies and the use of a unique formula, the pricing of domestically manufactured medicines is based on the cost price which leads to a significant price difference between imported drugs and domestically manufactured medicines.

In this regard, a study highlighted exchange rate fluctuations as one of the sources of risk for pharmaceutical companies (22). Another study illustrated that exchange rate fluctuations adversely affected pharmaceutical export. On average, a one percent increase in exchange rate fluctuations leads to a 0.17 percent decrease in pharmaceutical export in the short term (23). Accordingly, researchers found that exchange rate fluctuations could potentially affect expected cash flows of companies, capital expenditures, and corporate accounting evaluations (24). Similarly, the results showed that cash flow ranks fifth out of the ten risk factors affecting operations management performance in Iran's pharmaceutical supply chain (22). A study suggested that the first risk affecting sales management in the pharmaceutical supply chain in Iran had been dedicated to pricing policies (22). In addition, instability and fluctuation of price would increase the investment risk, so that it will be difficult for investors in the economic field of medicine to predict the situation (23). Unfair competition between domestically manufactured medicines and imported medicines resulting from pharmaceutical pricing policies have been proposed as a challenge for the pharmaceutical industry. Therefore, pricing strategies should be modified to provide competitive conditions in Iran's pharmaceutical markets. It should make it possible to produce higher-quality pharmaceutical products (5). One of the options offered is the elimination of subsidies and pricing by the pharmaceutical industry, which leads to a competitive market. This policy may not be very useful in the current market conditions. However, as long as the infrastructure is improved and the relevant procedures are followed, it can enhance pharmaceutical manufacturing quality and increase the incentive for foreign companies to invest in Iran's market (25).

Iran's position in global pharmaceutical export accounted for the largest share of marketing challenges. Due to the unexploited pharmaceutical manufacturing capacity in Iran and the existence of a large pharmaceutical market in neighboring countries and the region, targeting the markets of some countries including the Eastern Mediterranean, MENA Commonwealth, Eurasian :union:, European, African, Asian, and American countries can be helpful. This can be done by using strong communications and business teams to take advantage of this capacity and to increase the pharmaceutical products and their export at a competitive price to the target markets. The present study's findings indicated that Iran's share of the $70 million markets for medicinal plants and $100 billion global turnovers of medicinal plants is tiny and does not have a satisfactory position in the world. One of the reasons for the low market share of Iran is non-compliance with global pharmaceutical manufacturing standards and the emergence of strong competitors in the field of pharmaceutical export. This has led to the loss of pharmaceutical export corridor, especially in neighboring markets. Moreover, lack of knowledge about the laws, regulations, and process of registration of pharmaceutical products in target countries and the country's political issues such as sanctions have reduced exports to neighboring countries, including Afghanistan and African countries.

Regarding target market selection, market attractiveness should be systematically analyzed. Identifying and selecting target market will influence all subsequent decisions regarding types of services, distribution, pricing, and communication (26). The study results showed that the market penetration strategy, although not statistically significant, has a positive effect on export value. The coefficient of market development strategy or the number of export target countries has a positive and significant impact on sales. This means that as the number of target countries increases, exports increase significantly (27). The Balassa index study suggested that Iran has a high relative weakness in the pharmaceutical industry among the major exporting countries. Iran's RCA index for pharmaceutical products is less than one, indicating that Iran's pharmaceutical export share in total global export is low (5).

The most critical challenge in pharmaceutical manufacturing is pharmaceutical raw materials and quality improvement of products. Since most raw materials are supplied from abroad to produce medicine, disrupting financial and banking transactions due to sanctions has made it difficult to procure these materials. Thus, there will be no surplus left for exportable pharmaceutical products. Improving the quality of manufacturing raw materials and pharmaceutical products, and subsequently, obtaining GMP certification qualifications are essential to develop pharmaceutical industry. However, the pharmaceutical industry of Iran has faced major challenges due to ineligibility to get GMP requirements and the low quality of pharmaceutical manufacturing, despite having the necessary equipment.

Pertaining this, in many countries, the supply of raw materials and costs are also major obstacles (28). Therefore, since manufacturing of pharmaceutical products is highly dependent on imported raw materials, local manufacturing is a way out of this challenge. It can help the country's economy by increasing the volume of export (29). The study results showed that the second risk affecting the quality management performance in the pharmaceutical supply chain in Iran is the quality of raw materials (0.93) (22).

Economic sanctions have the most outstanding share of diplomatic challenges. As difficulties in the supply of raw materials, disruption in the transportation of raw materials to the country, and restrictions on financial and banking transactions that targeted the transfer of money, LC, and bank resources were the main challenges raised from imposed economic sanctions. These problems hindered production. Subsequently, the pharmaceutical export market is lost. In addition, Iran has not invested in some health tourism fields such as Iranian medicine and medicinal plants. This shows the weakness of health diplomacy and relations with foreign countries. Therefore, the standards required for international companies' approval must be reduced, and economic and marketing diplomacy muts be effectively promoted.

Similarly, sanctions have been identified as a potential risk factor, ranking first in the top ten major risks affecting the operations management in the pharmaceutical supply chain (22). Another study showed that the impact of collective sanctions imposed by the United States, the European :union:, and other countries had made export and import from and to Iran very challenging. This is because of potential trading partners' inability to transfer money to Iran in foreign currency (30).

Medicine smuggling is the biggest challenge in the domestic market. In Colombia, although exports are increasing, its market suffers from health system instability, counterfeiting and smuggling and lack of control and supervision (28). Medicines are illegally exported through reverse trade. It means that wholesalers repurchase the medicines for export from retail pharmacies or health care facilities. Although parallel trade within the EU is legal, substantial differences in drug prices may lead to drug shortages and

the development of methods such as reverse

traffic (31).

Conclusion

The pharmaceutical industry is one of the influential areas in achieving health, welfare and social security and equal opportunities, as well as access to essential drugs and vaccines. This is mentioned in the Vision Document 1404, Millennium Development Goals-Target 8-E and SDGs-Target 3.8.

This study explains the challenges in Iran’s pharmaceutical industry. It focuses on export by benefiting from media analysis approach. There are potential opportunities in Iran's pharmaceutical industry that the existing challenges have not provided the necessary conditions to achieve. Findings showed that Iran's position in international pharmaceutical export is not appropriate and its share is low.

In this regard, financing challenges, especially exchange rate fluctuations and pharmaceutical pricing strategies, have had a significant impact on the challenges of pharmaceutical manufacturing including the supply of raw materials.

On the other hand, improper pricing provides the basis for reverse medicine smuggling. In the diplomatic dimension, sanctions have also had a major impact on financial exchanges regarding the development of pharmaceutical export in Iran.

There is potential for Iran's pharmaceutical industry such as specialized human resources and various species of medicinal plants, as well as a strategic position in West Asia, etc. Authorities must turn challenges and threats into strengths and opportunities, and achieve the goals of the upstream documents.

For this purpose, it is possible to take measures such as establishing a fund for pooling and financing to pay the pharmaceutical companies receivables, reviewing pharmaceutical pricing policies, adopting regulatory measures to control medicines at the source and preventing the outflow of unconventional medicines. Authorities should also take measures to determine and apply real exchange rates commensurate with the target groups, consider tax exemptions for pharmaceutical innovations, produce local pharmaceutical raw materials, and promote domestically manufactured medicines. This is done while reviewing pharmaceutical export policies, provided the conditions for increasing pharmaceutical export, and developing the pharmaceutical industry are met.

Therefore, there is hope that by solving the mentioned challenges and paying the financial receivable and increasing liquidity, while investing in R and D, and exploiting unutilized manufacturing capacity, it will be possible to meet the country's pharmaceutical needs and target markets through exports.

The second limitation is that findings are general for the pharmaceutical sector. Specifically, each medicine category such as vaccines, herbal medicines, essential and specific medicines may face some unique challenges.

The third limitation is related to the effect of social desirability bias. This means that news quotations of stakeholders may have been described as what they thought the media desired to hear rather than the truth. Furthermore, some of them may have provided politically proper responses concerning their roles and responsibilities. Authors addressed these problems by triangulation of data sources, including analyzing news obtained from general and specialized online media news in Iran. Finally, media content analysis is one of the designs that rely on secondary data to analyze the situation of a social field. Hence, other designs such as quantitative and qualitative studies focusing on primary data may also be used to make the results more generalizable and rigorous.

Acknowledgements

The authors would like to appreciate Dr. Hajimiri for his advice on this study. They also thank the Health Services Management Research Center affiliated with the Institute for Futures Studies in Health at KUMS for approving and facilitating this study.

Conflict of interests

The authors declared no conflict of interests.

Authors’ Contributions

Yazdi-Feyzabadi V designed research; Ansari M conducted research; Ansari M and Yazdi-Feyzabadi V analyzed data; and Ansari M, Takian AH, and Yazdi-Feyzabadi V wrote the paper.

Yazdi-Feyzabadi V had primary responsibility for final content. All authors read and approved the final manuscript.

Funding

This study is part of a Ph.D. thesis, financed by the Research and Technology Deputy affiliated with Kerman University of Medical Sciences (KUMS). The funding body was not involved in the study design, study execution, or the writing of this manuscript.

Methods: This was a qualitative study which analyzed the content of general and specialized online media news in Iran (conventional approach) from January 20, 2017 to January 20, 2020. Data sources were selected using the purposive sampling method .Then, the eligible news was determined by quota sampling method and was inductively analyzed in MAXQDA10.

Results: The identified challenges were divided into five main categories including the domestic market of medicines, pharmaceutical manufacturing, financing, marketing and diplomacy. The most important challenges were related to financing and marketing.

Conclusion: Iran's position regarding worldwide export of drugs is not satisfactory. The target markets for drug exports should be developed using a national economic program and appropriate diplomacy, in addition to improving the quality of drug production.

Key words: Challenge, Export, Pharmaceutical, Media analysis, Iran.

Introduction

Pharmaceutical industry is one of the top five industries in the global economy (1). International medicine exports amounted to $ 680 billion in 2020 (2). This is while Iran, with US$ 96 million in pharmaceutical export, accounted for a small share (0 %) of the international pharmaceutical exports and ranked the 76th (2). Based on the timeline and despite the establishment of pharmaceutical factories, nationalization of the industry, implentation of a comprehensive plan, and investment in the sector, Iran's pharmaceutical industry is still struggling. Due to sanctions, Iran’s pharmaceutical industry has been unable to obtain raw materials and has had difficulties with currency transfers and financial transactions. Moreover, Iran could not take advantage of pharmaceutical factories and facilities available for the production and export of pharmaceutical goods. The evolution of Iran's pharmaceutical industry is shown in a timeline (Figure 1) (3).

Studies have shown that as the global monopoly of exporters decreases, the import seeks monopoly in the competition (4). Iran has a small share of the world's pharmaceutical exports (5). The structure of Iran's pharmaceutical exports has been moving towards opening multiple monopolies (4). In addition, some studies have identified the barriers to market access including import restrictions and intellectual property protection, price control laws, access to foreign exchange policy, certificate of non-production, and government's purchase and participation to develop production (6). Another study identified India as one of the largest suppliers of medicines to Nigeria at low prices (7).

Iran's strategic position in West Asia provides an excellent opportunity for the country to enter other countries' health system through pharmaceutical exports and currency inflows into Iran. Furthermore, according to the Millennium Development Goals (MDGs) and the Sustainable Development Goals (SDGs) (8, 9), as well as the emphasis of the country's upstream documents (10-13), the development of pharmaceutical exports appears as one of the economic development strategies (4, 14). Therefore, this study aims to explain the challenges in Iran’s pharmaceutical industry with focus on export through the media analysis approach.

Materials and Methods

Study design

- This study was a qualitative content analysis (15). The data from January 20, 2017, to January 20, 2020, coinciding with the sixth National Development Plan (NDP) were used to identify the challenges of pharmaceutical export in Iran.

The most important online news sources were specified using purposive sampling. They included general and specialized press agencies and sites selected through quota sampling.

The inclusion criteria for the selection of online media news resources were as follows:

- Reputable and most visited news websites managed by press agencies in ranking list of Iranian news websites

- Online media news approved by official and governmental authorities

- Persian-language news sources published nationally

- News items related to "pharmaceutical export", "export of medicines", and their derivatives

• News sources with non-Persian languages

• News published locally

• News unrelated to "drug export"

• News published about pharmaceutical export in other countries

• News items that had not been released within the studied period.

A description of these news outlets is shown in Table 1.

Search and keywords

Data were collected by searching the keywords "medicine", "Pharmaceutical Products", Export", and "Iran" in Persian in the news sources from January 20, 2017, to January 20, 2020. The retrieved, removed, and analyzed news are shown in Figure 2.

Data analysis

The authors used media content analysis to examine the challenges of pharmaceutical export in Iran. Content analysis refers to a set of techniques for analyzing communication sets (16). In the first stage, the inductive approach of conventional qualitative content analysis was used. The analysis units were identified by referring to different pieces of news and their frequency. In the second stage, according to the content of the analysis unit, the initial coding was done. The aggregation of similar codes and formation of sub-classes hidden in the text was the third stage of data analysis. In the next stage, these sub-classes were compared with each other. Those closer to each other were subdivided into the main class, including the domestic market of medicines, pharmaceutical manufacturing, financing, marketing and diplomacy. Finally, the findings obtained from the media were presented and interpreted (17-20).

The four criteria proposed by Lincoln and Guba (1985) (21), such as credibility, transferability, dependability and confirmability were used to ensure the trustworthiness of the results. The credibility of data was enhanced through immersion in prolonged engagement and persistent observation for several months while retrieving the news and coding process.

Furthermore, peer debriefing was used to increase the credibility of data. To this end, a round-trip coding process was performed through the research team members.

To meet transferability, the number of news retrieved from each source and used in data analysis was briefly described (Table 1). Finally, in order to enhance dependability, the categories, subcategories, codes, and direct quotations for each code were reported to ensure consistency between the findings, interpretations, and conclusions raised from data.

This study is part of a Ph.D. thesis, financed by the Research and Technology Deputy affiliated with Kerman University of Medical Sciences (KUMS) with ethical approval number IR.KMU.REC.1398.717.

The authors used media content analysis to examine the challenges of pharmaceutical export in Iran. Content analysis refers to a set of techniques for analyzing communication sets (16). In the first stage, the inductive approach of conventional qualitative content analysis was used. The analysis units were identified by referring to different pieces of news and their frequency. In the second stage, according to the content of the analysis unit, the initial coding was done. The aggregation of similar codes and formation of sub-classes hidden in the text was the third stage of data analysis. In the next stage, these sub-classes were compared with each other. Those closer to each other were subdivided into the main class, including the domestic market of medicines, pharmaceutical manufacturing, financing, marketing and diplomacy. Finally, the findings obtained from the media were presented and interpreted (17-20).

The four criteria proposed by Lincoln and Guba (1985) (21), such as credibility, transferability, dependability and confirmability were used to ensure the trustworthiness of the results. The credibility of data was enhanced through immersion in prolonged engagement and persistent observation for several months while retrieving the news and coding process.

Furthermore, peer debriefing was used to increase the credibility of data. To this end, a round-trip coding process was performed through the research team members.

To meet transferability, the number of news retrieved from each source and used in data analysis was briefly described (Table 1). Finally, in order to enhance dependability, the categories, subcategories, codes, and direct quotations for each code were reported to ensure consistency between the findings, interpretations, and conclusions raised from data.

This study is part of a Ph.D. thesis, financed by the Research and Technology Deputy affiliated with Kerman University of Medical Sciences (KUMS) with ethical approval number IR.KMU.REC.1398.717.

Results

After removing duplicate news, 11 news sources out of 12 were used for analysis. The highest number of related news was published in 2019 (37 %), 2017 (34 %), and 2018 (29 %), respectively. Overall, the highest number of related news per year was retrieved from Sepidonline News Agency (33.8 %), followed by Khabaronline (20.1 %), and Ifdana (13.8 %).

A survey of players regarding the export of pharmaceutical industry showed that the Food and Drug Administration (19.6 %), national bodies (13.2 %), and the Islamic Consultative Assembly (12.9 %) had the most significant contribution respectively. Furthermore, "other organizations" included 12 organizations (this category included General Deparment of Natural Resources And Watershed Management, foreign pharmaceutical companies, Supreme National Security Council, Academy of Medical Sciences, Charity Foundation for Special Diseases, the Islamic Republic of Iran Customs Administration (IRICA), Export Department of the Central Bank, World Health Organization Eastern Mediterranean Regional Office, Iranian Red Crescent Society, Transparency and Justice Observatory, Embassies of other countries in Iran, and Nursing Organization Of Islamic Republic of Iran) with a frequency of 1 (Figure 3).

Five main categories were emerged: the domestic market of medicines, pharmaceutical manufacturing, financing, marketing, and diplomacy. Moreover, 16 subcategories and 34 codes were extracted, as presented in Table 2.

1. Domestic market of medicines

To analyze the situation of pharmaceutical export in Iran, it is necessary to know the current situation of the domestic market to export surplus. Thus, the quantity of the medicines imported into the country, the status and stock of drugs and its possible shortages, market stability, and investigating the availability of a platform for medicine smuggling were identified as factors and challenges affecting the domestic medicines market. These challenges were divided into two subcategories: Recognizing and regulating Iran’s pharmaceutical market.

"The value of the currency outflow spent on 3% of imported medicines has amounted to over one billion dollars, showing a huge difference in the import and export of medicines" (Salamat News, October 15, 2019).

1.2. Regulating the country's pharmaceutical market: A review of the selected news indicated that one of the most critical factors in developing each country's export is market regulation. Thus, the pharmaceutical market is regulated by identifying drug shortages, providing access to them, and stabilizing them. Of course, both domestically and internationally, medicine smuggling is a major factor in creating market chaos.

1.2.1. Access to essential medicines and a scarcity of medicines: Some of the challenges in Iran's pharmaceutical industry include the shortage of medicines due to problems of the administrative system, the customs clearance, order registration process, and time difference in currency allocation. The spokesman of the Food and Drug Administration mentioned the above problems as below:

"Sometimes there are problems with the customs clearance and the administrative system or the process of registering the orders and forecasting the required medicine which may lead to a temporary shortage of medicines; however, these problems are resolved quickly" (Phana, April 16, 2018).

1.2.2. Market stability: The news review demonstrated that the change in government's behavior regarding the agencies, changes in working conditions in production, trade, and business sectors, and changes in decisions in the export field are some challenges in the pharmaceutical industry. They may lead to market instability. Accordingly, the representative of the Chamber of Commerce stated:

"One of our problems in the field of health economics is that there are constant changes in working conditions in production, trade, and business sectors by the governing bodies " (SepidOnline, June 23, 2019).

1.2.3 Medicine smuggling: Medicine smuggling caused by supplying medicine with a currency of 4200 tomans and the money earned from medicine smuggling won't be returned to the pharmaceutical industry. The low price of domestically manufactured medicine and mismatch of the cost price of the drug with its expense are some of the challenges affecting the pharmaceutical industry. The representative of the :union: of Drug Importers stated:

"The Ministry of Health is concerned that the medicines are imported to the country at the special currency rate and in large volume. The imported medicines injected into the market pave the way for reverse smuggling and exporting of the medicines from the domestic market to other countries" (TCCIMA, August 19, 2018).

2.1. Manufacturing cycle: The manufacturing cycle involves the requirements, infrastructure, and required processes for converting pharmaceutical raw materials into pharmaceutical products. It includes “Pharmaceutical raw materials”, “pharmaceutical manufacturing technology”, “Production line and factory infrastructure”, and “Manufacturing capacity”.

2.1.1. Raw materials: Dependency of Iran's pharmaceutical industry on foreign countries for the supply of medicinal raw materials, failure to use the potential of medicinal plants and inability to achieve the vision document goals on land development were among the challenges of the pharmaceutical industry. According to the representative of the Iran-UAE Joint Chamber of Commerce:

"Today, some companies import raw materials and market them through a simple process, and eventually, packaging. This issue ultimately makes the country as a consumer and an applicant for foreign companies to produce required medicines, again." (the SOHDI of Iran, September 25, 2019)

2.1.2. Pharmaceutical manufacturing technology: Technological weakness, neglect of commercialization of technology in the field of pharmacy, and lack of government's spending on pharmaceutical industry updates were the challenges pharmaceutical manufacturing technology has faced. This led to the weakening of the pharmaceutical supply chain and declining pharmaceutical export. In this regard, the representative of the Federation of Energy Exports and Related Industries of Iran stated:

"Among the weaknesses in this field, we can mention …, general technological weaknesses in most companies operating in this industry" (the SOHDI of Iran, September 19, 2019)

2.1.3. Production line and factory infrastructure: Not using the potential of medicinal plants despite the available infrastructure, inappropriate circumstances of factories and their need for reconstruction, and innovation and inability to spend money on production were examples of challenges affecting pharmaceutical manufacturing. According to the Minister of Health:

"If there was more support and the institute had enough infrastructure in terms of the number of laboratories, space, and other necessary facilities, the country could have more achievements in pharmaceutical manufacturing" (Sepidonline, February 8, 2017).

2.1.4. Manufacturing capacity: The existence of unexploited pharmaceutical manufacturing capacity, inconsistency of manufacturing capacity with the quantity of pharmaceutical export were some challenges of pharmaceutical manufacturing capacity for Iran's pharmaceutical export. In this regard, it is stated that:

"Reviews show that pharmaceutical manufacturing capacity in Iran is three times more than the domestic need. At the same time, the quantity of pharmaceutical export is not as satisfactory as it should be, …" (Sepidonline, September 30, 2018).

2.2 Sources of information and knowledge required for manufacturing: A review of the news indicated that “documentation”, “knowledge”, “R and D” and “pharmaceutical products registration” were identified as necessary information and knowledge resources for manufacturing and exporting pharmaceutical products.

2.2.1 Documentation: In some news stories, however, it was noted that pharmaceutical companies lack documentation. For instance, in response to the question of what items the export of medicines needs, a member of the board of directors of the Tehran Pharmacists Association stated:

"… improving documentation in pharmaceutical manufacturing … is one of the things that needs serious attention" (Phana, March 26, 2017).

2.2.2 Knowledge: There is a need to import knowledge in pharmaceutical manufacturing and and an increase in the demand for training and transferring knowledge to pharmaceutical manufacturing companies. This shows the lack of expertise in the pharmaceutical industry. Accordingly, the representative of the Ministry of Health said:

"The proposed plan for pharmaceutical manufacturing needs to be studied following the state-of-the-art science and knowledge, and the necessary advice and assistance should be given to knowledge-based companies for commercialization, and companies should increase their knowledge and experience" (Sepidonline, July 12, 2018).

2.2.3. R and D: A review of the news indicated that the suspension of currency allocation for pharmaceutical research, ignoring spending on R and D and marketing activities due to ineffective pricing methodology, and disrupting investment in R and D by the generic system were some challenges faced by the pharmaceutical industry. In this regard, the representative of Tehran Pharmacists Association stated:

"Domestically manufactured medicines are priced using the old cost-plus method. This pricing method … has ignored the cost of R and D and improvement of pharmaceutical manufacturing lines in the industry" (Sepidonline, October 17, 2017).

2.2.4. Pharmaceutical products registration: The disruption of the pharmaceutical products registration process in some destination countries was another challenge for the pharmaceutical industry, as was mentioned by the representative of the International Department of the Food and Drug Administration:

"Unfortunately, in recent years, there have been challenges regarding the registration of Iranian pharmaceutical products in Iraq, and we negotiated with the Iraqi officials to address these challenges… The number of Iranian pharmaceutical products registered in the Iraqi pharmaceutical market is less than 20 items…" (Sepidonline, September 2, 2018).

2.3 The quality of pharmaceutical products: One of the requirements for pharmaceutical export is the acceptable quality of pharmaceutical products. In this field, “improving the quality of pharmaceutical products” and “optimal packaging” were identified and examined.

2.3.1 The quality of pharmaceutical products: Some challenges related to the quality of pharmaceutical products are the following: Decreased quality of manufactured medicines and occurrence of unhealthy behaviors in the field of health, lack of investment in the quality of domestically manufactured medicines, the same pricing for medicines with different qualities, pharmaceutical manufacturing factories establishment regardless of international standards, lack of Good Manufacturing Practice (GMP) qualifications, and not obtaining international certificates needed for pharmaceutical export. According to the representative of Iran-UAE Joint Chamber of Commerce:

"Many of our factories have been established without complying with international standards; thus, when entering the field of export, even to neighboring countries, unfortunately, they will face challenges regarding production standards of destination countries". (the SOHDI of Iran, September 25, 2019).

2.3.2 Packaging: Some news outlets stated the weakness of the packaging industry, the need for cash payments to provide packaging requirements and the increased cost of pharmaceutical products packaging as packaging challenges in the pharmaceutical industry. While pointing out these challenges, the CEO of a pharmaceutical company stated:

"Unfortunately, we are facing a situation where we have more problems in supplying domestic necessities than imported necessities; so, we need cash payments for supplying boxes, brochures, cartons, etc., creating a heavy financial burden for us" (Salamat News, September 8, 2018).

3. Financing

One of the controlling factors in the health system, spesifically the pharmaceutical industry, is financing. The financing issues identified in this study were “ ability to pay receivables”, “international financial transactions and exchanges", “investment”, and “pharmaceutical pricing policy and system”:

3.1 Ability to pay receivables: One of the responsibilities of the government, insurance companies, medical centers, and pharmacies is to deliver the pharmaceutical companies' receivables. “Receivables” and “Liquidity” were the identified components of this issue.

3.1.1 Receivables: Pharmaceutical companies receivables from insurance organizations, prolonging the receivable payments period, working capital problems, delays in receivable payments from the National Development Fund, and wrong choice of Health Insurance Organization to pay receivables were some of the identified challenges in this field. Concerning these problems, the spokesman of the Food and Drug Administration stated:

" … but the market trend … is such that after the manufacturing and sale of medicines, the pharmaceutical companies' receivables are not paid in cash, and due to delayed payments by insurance companies, receivables are in arrears. The time period for payment of pharmaceutical companies receivables has increased." (Phana, April 16, 2018).

3.1.2. Liquidity: Lack of liquidity due to poor government's performance, non-payment of receivables by insurance organizations, pharmaceutical pricing, liquidity challenges, and their impact on pharmaceutical raw materials and pharmaceutical supply chain were identified as liquidity-related challenges. In this regard, a pharmaceutical industry activist stated:

"A major problem the pharmaceutical industry faces is the lack of liquidity in the pharmaceutical drug market, which has caused drug shortage" (Salamat News, April 30, 2019).

3.2 International financial transactions and exchanges: One of the issues related to the pharmaceutical industry's financing is international financial transactions and exchanges of which “exchange rate” and “LC” and banking transactions” were the identified components in this context.

3.2.1 Exchange rate: Findings indicated that the rising exchange rate, low value of the domestic currency, medicine smuggling due to multiple-exchange rates, currency outflow from import, allocation of government's currency to medicine imports, and instability and exchange rate fluctuations were some exchange rate challenges. For instance, the representative of Tehran University of Medical Sciences stated:

"The results of a study showed that a one-percent increase in exchange rate fluctuations on average can reduce 17 percent of exports of medical equipment and medicine in the short term" (Sepidonline, January 1, 2020).

3.2.2 LC and banking transactions: Based on the results of the present study, the restriction on opening LC accounts was a challenge in banking transactions, so that one of the members of the Islamic Consultative Assembly mentioned:

"Banking sanctions have targeted money transfer, LC and banking transactions, and may reduce maneuvering power" (Khane Mellat News Agency, May 11, 2018).

3.3. Investment: One of the ways to develop the pharmaceutical industry is to invest in domestic and foreign markets.

3.3.1 Foreign investment: They cover the investments made by other countries in Iran, by Iran in other countries, and joint investments and ventures. Issues such as insufficient foreign investment in Iran, difficulties in attracting foreign investors and domestic resistance to it, unwillingness of foreign companies to invest due to political issues, and constant changes in the policies of the Ministry of Health and its affiliated organizations were identified challenges in this context. According to the representative of the Chamber of Commerce:

"Strict and unprofessional programs of the Ministry of Health have made the presence of foreign companies in our country and pharmaceutical manufacturing non-cost-effective. For this reason, … only under the license of foreign companies has production started". (TCCIMA, June 19, 2017)

3.3.2 Domestic investment: This section focuses on Iranian investment in the country's pharmaceutical industry. Lack of government support for new investments in the industry, inadequate investment, inability of the private sector and improper investment of governmental industry in this field, and the unique approach adopted by state-owned and quasi-state-owned pharmaceutical companies were some of the domestic investment challenges. As the representative of the Chamber of Commerce mentioned:

"Most pharmaceutical companies are state-owned or quasi-state-owned factories and do not make new investments, …" (TCCIMA, April 9, 2017).

3.4 Pharmaceutical pricing policy and system: One of the stages of pharmaceutical manufacturing is its pricing, which is affected by the costs incurred in different manufacturing stages. In this regard, pharmaceutical pricing policies addressed pharmaceutical prices, drug pricing mechanisms, and subsidies as discussed below.

3.4.1 Pharmaceutical prices: Inconsistency between manufacturing costs and domestic pharmaceutical prices, pharmaceutical manufacturing costs exceeding domestic pharmaceutical sales prices, unrealistic domestic pharmaceutical prices, price suppression due to government financial inability, and imposing unreasonable fees on the pharmaceutical industry were some challenges of the pharmaceutical pricing system. In response to the question of what factors have caused the crisis in the pharmaceutical industry, the former chairman of the Food and Drug Administration added:

"Part of the industry's problems are due to the unrealistic prices of domestically manufactured medicines" (Sepidonline, December 19, 2017).

3.4.2 Pharmaceutical pricing mechanism: Some of the identified pharmaceutical pricing challenges in this study were changing the basis of pharmaceutical pricing. They are unfair competition, the difference in prices of domestically manufactured medicines and imported medicines due to pricing method and improper pricing system, and not applying the new one. According to the spokesman of the Food and Drug Administration:

"If we can go in the direction of changing the pharmaceutical pricing mechanism from the situation based on cost-price to reference-price and change the basis of pharmaceutical pricing, we can hope for the development of the country's pharmaceutical industry" (Phana, April 16, 2018).

3.4.3 Subsidies: Elimination of subsidies for the export of pharmaceutical items which received subsidies directly and forcing pharmaceutical exporters to return pharmaceutical subsidies were some of the challenges. One of the members of the Islamic Consultative Assembly stated:

"The export of medicine is not so substantial, such that the government wants to withdraw subsidies from exporters" (Khane Mellat, October 7, 2017).

“We have made many efforts for the export and registration of medicines abroad, but unfortunately, Iran’s industry is not well familiar with marketing abroad” (Salamat News, January 23, 2018).

4.1. Branding: This is to introduce domestically manufactured pharmaceutical products, build trust to absorb investment, and increase the likelihood of pharmaceutical export. It is done by increasing marketing efficiency and effectiveness, creating a sense of customer loyalty to the brand, improving profitability margin, gaining leverage among customers, and achieving a different competitive advantage.

4.1.1 Advertising: Weakness and prohibition of advertising activities for domestically manufactured pharmaceutical products were some challenges in this area as pointed out by the chairman of the Food and Drug Administration:

"We have poor performance in promoting domestically manufactured medicines, and this has made us somewhat incapable of introducing capabilities of the pharmaceutical industry to the people and the world" (Salamat News, October 15, 2019).

4.2 Export pharmaceutical products: Exporting pharmaceutical products include domestically manufactured medicines which are exported to target markets. One of the challenges in this area was related to medicinal plants.

4.2.1 Herbal medicines: Despite the existence of various species of medicinal plants in Iran, the necessary infrastructure for the production of herbal medicine does not exist. For this reason, medicinal plants are exported abroad, and herbal medicines are produced and imported into the country. Other challenges in this area are doctors' disregard for traditional medicine and herbal medicines, excessive harvesting of natural resources, collecting plants from sources by non-specialized people, mismatch between the production of herbal medicines and their manufacturing capacity, and the impossibility of extracting high-tech plants. According to the head of the Pharmacy Committee of the Scientific Association of Traditional Medicine:

"In Iran, many companies are operating in the field of herbal medicine production, but the amount of production is not commensurate with the country's capacity" (Salamat News, July 11, 2017).

4.3 Export destinations: One of the marketing advantages and goals is to identify the audience to introduce products. For this purpose, in addition to developing the pharmaceutical industry and identifying Iran's position in the global pharmaceutical industry, export destinations were identified and examined.

4.3.1 Developing the pharmaceutical market: Market development is hindered by some challenges such as non-payment of financial receivables by insurance companies, pharmaceutical companies facing liquidity challenges, inattention to branding, pharmaceutical manufacturing by the government, and unwillingness of countries to invest in Iran's pharmaceutical industry. The Minister of Health stated:

"The government's involvement is one of the obstacles to the growth and development of Iranian pharmaceutical export" (Sepidonline, January 15, 2018).

4.3.2 Iran's position in global pharmaceutical export: An improper status regarding pharmaceutical export, failure to reach a satisfactory position according to Iran's 20-Year Vision Document, and low share of domestically manufactured medicines in the pharmaceutical market were some challenges hindering international export. As highlighted by the Minister of Health:

"Pharmaceutical export from Iran is not significant, and we are sorry that the pharmaceutical industry doesn't have a proper position in the export field and has not obtained an acceptable one in the regional market …" (Salamat News, January 23, 2018).

4.3.3 Target markets: Several countries in different regions, including neighboring countries (Turkey), Eastern Mediterranean Region countries(Syria), MENA (Algeria), Commonwealth of Independent States (CIS) (Uzbekistan), Eurasian :union: (Belarus), Asian (Thailand), European (Ukraine), African (Uganda), and American (Cuba) countries were identified as target markets for domestically manufactured pharmaceutical products. Concerning the establishment of pharmaceutical factories in other countries, the Deputy of Management and Resources Development of the Food and Drug Administration stated:

"Currently, due to Iran's progress in the production of biotechnology drugs, we are establishing factories in Turkey and Russia, and the markets of Iraq, Afghanistan, and Belarus are our export targets, …" (Sepidonline, September 10, 2018).

4.4. Competition: The competition of actors and maintenance of export corridor were identified as requirements for pharmaceutical export. This is according to the concept of competition based on the ability to change the characteristics of industries and producing products with competitive advantages in changing environmental conditions.

4.4.1 Competition of actors and maintenance of the export corridor: Unfair competition due to improper pharmaceutical pricing methods, current laws and restrictions, lack of government support, the emergence of strong competitors, adverse financial conditions and sanctions have led to the loss of export markets and reduced export of Iran's pharmaceutical products. A member of the board of Tehran Pharmacists Association regretted that in recent years Iran has lost the markets of neighboring countries expressed:

"The emergence of strong competitors such as Jordan with exports of nearly one billion dollars and Turkey with exports of 935 billion dollars in 2015 and a 50 percent increase in exports in the previous five years are some of the factors causing the loss of export market in Iran" (Phana, March 26, 2017).

4.5 Cooperation and partnership: One of the prerequisites for pharmaceutical industry's success is the cooperation and partnership of small and large pharmaceutical companies with each other and team building to achieve growth and development through the synergy created.

4.5.1 Alliances, export-oriented teams, and effective business communication: The review of the selected news revealed that Iran would not have an ideal performance in exporting medicines without internal alliances and having a good relationship with other pharmaceutical companies and effective marketing worldwide. Similarly, a member of the TCCIMA stated:

"The quality, and even, the quantity of pharmaceutical manufacturing cannot ensure successful exports. Having effective trade relations and a strong business team to sell domestically manufactured medicines abroad is crucial for export" (the SOHDI of Iran, September 18, 2019).

5.1 Pharmaceutical export and political relations: Governments' political conditions and relations can act as a driving force or a deterrent to the development of the pharmaceutical industry and export. In this regard, international sanctions and the JCPOA were factors affecting Iran’s pharmaceutical export.

5.1.1 Sanctions: The news review revealed some issues such as disruption of the pharmaceutical supply chain, difficulty in financial transactions and currency transfers, disruption of marketing and transportation activities, reduced exports and increased reverse smuggling of domestically manufactured medicines were challenges resulting from sanctions. According to the CEO of a pharmaceutical company:

"Non-supply and non-sale of raw materials to Iran, non-transportation of Iranian medicines on international lines, non-insurance of Iranian shipments, etc. are some of the problems faced by the pharmaceutical industry after the new sanctions" (the SOHDI of Iran, September 11, 2019).

5.1.2 JCPOA: Content analysis of the news indicated that inability to produce drugs, recession and lack of acceptance of Iran's pharmaceutical products, the problem with drug transfer and the increase in drug prices due to transportation costs were challenges affecting Iran's pharmaceutical industry before JCPOA:

"In the pre- JCPOA period, Iran's pharmaceutical products and medical equipment did not have many customers because sanctions had affected recession and the country's pharmaceutical industry didn't have the necessary capacity to manufacture its products" (Phana, January 28, 2017).

5.2 Diplomacy tools: Examining and selecting the right diplomacy tools is very effective in the success of diplomacy. Holding exhibitions and specifying rules and regulations were effective practical tools in advancing diplomacy.

5.2.1 Holding an Exhibitions: The results of this study indicated that Iran's pharmaceutical industry suffers from the absence of standard domestic exhibitions. Accordingly, the representative of the Iran-UAE Joint Chamber of Commerce stated:

"Our exhibitions are still far from international standards, and I must say that if we fill this gap, we will take the first step in effective pharmaceutical export abroad" (the SOHDI of Iran, September 25, 2019).

5.2.2 Rules and regulations: The most powerful tools for diplomacy which are enforceable are rules and regulations. Loss of export markets due to laws and restrictions, defective laws, lack of national drug policy, instability of decisions and programs, non-implementation of article 44 of the Constitution on the entry of people into the drug market, amendment of Value-added Tax (VAT) Act and other countries' laws and regulations were some of the challenges related to diplomatic tools. According to the chairman of the Food and Drug Administration:

"Another important issue is the lack of legally approved national drug policies. There are approvals in the organization that can change as each team changes, and we must have an approved policy that can be implemented in all sectors" (Khabar Online, July 16, 2019).

After removing duplicate news, 11 news sources out of 12 were used for analysis. The highest number of related news was published in 2019 (37 %), 2017 (34 %), and 2018 (29 %), respectively. Overall, the highest number of related news per year was retrieved from Sepidonline News Agency (33.8 %), followed by Khabaronline (20.1 %), and Ifdana (13.8 %).

A survey of players regarding the export of pharmaceutical industry showed that the Food and Drug Administration (19.6 %), national bodies (13.2 %), and the Islamic Consultative Assembly (12.9 %) had the most significant contribution respectively. Furthermore, "other organizations" included 12 organizations (this category included General Deparment of Natural Resources And Watershed Management, foreign pharmaceutical companies, Supreme National Security Council, Academy of Medical Sciences, Charity Foundation for Special Diseases, the Islamic Republic of Iran Customs Administration (IRICA), Export Department of the Central Bank, World Health Organization Eastern Mediterranean Regional Office, Iranian Red Crescent Society, Transparency and Justice Observatory, Embassies of other countries in Iran, and Nursing Organization Of Islamic Republic of Iran) with a frequency of 1 (Figure 3).

Five main categories were emerged: the domestic market of medicines, pharmaceutical manufacturing, financing, marketing, and diplomacy. Moreover, 16 subcategories and 34 codes were extracted, as presented in Table 2.

1. Domestic market of medicines

To analyze the situation of pharmaceutical export in Iran, it is necessary to know the current situation of the domestic market to export surplus. Thus, the quantity of the medicines imported into the country, the status and stock of drugs and its possible shortages, market stability, and investigating the availability of a platform for medicine smuggling were identified as factors and challenges affecting the domestic medicines market. These challenges were divided into two subcategories: Recognizing and regulating Iran’s pharmaceutical market.

-

- Recognizing Iran’s pharmaceutical market: The current situation of the domestic market of medicines in the media was examined following the index of “Frequency of pharmaceutical imports to Iran”.

"The value of the currency outflow spent on 3% of imported medicines has amounted to over one billion dollars, showing a huge difference in the import and export of medicines" (Salamat News, October 15, 2019).

1.2. Regulating the country's pharmaceutical market: A review of the selected news indicated that one of the most critical factors in developing each country's export is market regulation. Thus, the pharmaceutical market is regulated by identifying drug shortages, providing access to them, and stabilizing them. Of course, both domestically and internationally, medicine smuggling is a major factor in creating market chaos.

1.2.1. Access to essential medicines and a scarcity of medicines: Some of the challenges in Iran's pharmaceutical industry include the shortage of medicines due to problems of the administrative system, the customs clearance, order registration process, and time difference in currency allocation. The spokesman of the Food and Drug Administration mentioned the above problems as below:

"Sometimes there are problems with the customs clearance and the administrative system or the process of registering the orders and forecasting the required medicine which may lead to a temporary shortage of medicines; however, these problems are resolved quickly" (Phana, April 16, 2018).

1.2.2. Market stability: The news review demonstrated that the change in government's behavior regarding the agencies, changes in working conditions in production, trade, and business sectors, and changes in decisions in the export field are some challenges in the pharmaceutical industry. They may lead to market instability. Accordingly, the representative of the Chamber of Commerce stated:

"One of our problems in the field of health economics is that there are constant changes in working conditions in production, trade, and business sectors by the governing bodies " (SepidOnline, June 23, 2019).

1.2.3 Medicine smuggling: Medicine smuggling caused by supplying medicine with a currency of 4200 tomans and the money earned from medicine smuggling won't be returned to the pharmaceutical industry. The low price of domestically manufactured medicine and mismatch of the cost price of the drug with its expense are some of the challenges affecting the pharmaceutical industry. The representative of the :union: of Drug Importers stated:

"The Ministry of Health is concerned that the medicines are imported to the country at the special currency rate and in large volume. The imported medicines injected into the market pave the way for reverse smuggling and exporting of the medicines from the domestic market to other countries" (TCCIMA, August 19, 2018).

- Pharmaceutical manufacturing

2.1. Manufacturing cycle: The manufacturing cycle involves the requirements, infrastructure, and required processes for converting pharmaceutical raw materials into pharmaceutical products. It includes “Pharmaceutical raw materials”, “pharmaceutical manufacturing technology”, “Production line and factory infrastructure”, and “Manufacturing capacity”.

2.1.1. Raw materials: Dependency of Iran's pharmaceutical industry on foreign countries for the supply of medicinal raw materials, failure to use the potential of medicinal plants and inability to achieve the vision document goals on land development were among the challenges of the pharmaceutical industry. According to the representative of the Iran-UAE Joint Chamber of Commerce:

"Today, some companies import raw materials and market them through a simple process, and eventually, packaging. This issue ultimately makes the country as a consumer and an applicant for foreign companies to produce required medicines, again." (the SOHDI of Iran, September 25, 2019)

2.1.2. Pharmaceutical manufacturing technology: Technological weakness, neglect of commercialization of technology in the field of pharmacy, and lack of government's spending on pharmaceutical industry updates were the challenges pharmaceutical manufacturing technology has faced. This led to the weakening of the pharmaceutical supply chain and declining pharmaceutical export. In this regard, the representative of the Federation of Energy Exports and Related Industries of Iran stated:

"Among the weaknesses in this field, we can mention …, general technological weaknesses in most companies operating in this industry" (the SOHDI of Iran, September 19, 2019)

2.1.3. Production line and factory infrastructure: Not using the potential of medicinal plants despite the available infrastructure, inappropriate circumstances of factories and their need for reconstruction, and innovation and inability to spend money on production were examples of challenges affecting pharmaceutical manufacturing. According to the Minister of Health:

"If there was more support and the institute had enough infrastructure in terms of the number of laboratories, space, and other necessary facilities, the country could have more achievements in pharmaceutical manufacturing" (Sepidonline, February 8, 2017).

2.1.4. Manufacturing capacity: The existence of unexploited pharmaceutical manufacturing capacity, inconsistency of manufacturing capacity with the quantity of pharmaceutical export were some challenges of pharmaceutical manufacturing capacity for Iran's pharmaceutical export. In this regard, it is stated that:

"Reviews show that pharmaceutical manufacturing capacity in Iran is three times more than the domestic need. At the same time, the quantity of pharmaceutical export is not as satisfactory as it should be, …" (Sepidonline, September 30, 2018).

2.2 Sources of information and knowledge required for manufacturing: A review of the news indicated that “documentation”, “knowledge”, “R and D” and “pharmaceutical products registration” were identified as necessary information and knowledge resources for manufacturing and exporting pharmaceutical products.

2.2.1 Documentation: In some news stories, however, it was noted that pharmaceutical companies lack documentation. For instance, in response to the question of what items the export of medicines needs, a member of the board of directors of the Tehran Pharmacists Association stated:

"… improving documentation in pharmaceutical manufacturing … is one of the things that needs serious attention" (Phana, March 26, 2017).

2.2.2 Knowledge: There is a need to import knowledge in pharmaceutical manufacturing and and an increase in the demand for training and transferring knowledge to pharmaceutical manufacturing companies. This shows the lack of expertise in the pharmaceutical industry. Accordingly, the representative of the Ministry of Health said:

"The proposed plan for pharmaceutical manufacturing needs to be studied following the state-of-the-art science and knowledge, and the necessary advice and assistance should be given to knowledge-based companies for commercialization, and companies should increase their knowledge and experience" (Sepidonline, July 12, 2018).

2.2.3. R and D: A review of the news indicated that the suspension of currency allocation for pharmaceutical research, ignoring spending on R and D and marketing activities due to ineffective pricing methodology, and disrupting investment in R and D by the generic system were some challenges faced by the pharmaceutical industry. In this regard, the representative of Tehran Pharmacists Association stated:

"Domestically manufactured medicines are priced using the old cost-plus method. This pricing method … has ignored the cost of R and D and improvement of pharmaceutical manufacturing lines in the industry" (Sepidonline, October 17, 2017).

2.2.4. Pharmaceutical products registration: The disruption of the pharmaceutical products registration process in some destination countries was another challenge for the pharmaceutical industry, as was mentioned by the representative of the International Department of the Food and Drug Administration:

"Unfortunately, in recent years, there have been challenges regarding the registration of Iranian pharmaceutical products in Iraq, and we negotiated with the Iraqi officials to address these challenges… The number of Iranian pharmaceutical products registered in the Iraqi pharmaceutical market is less than 20 items…" (Sepidonline, September 2, 2018).

2.3 The quality of pharmaceutical products: One of the requirements for pharmaceutical export is the acceptable quality of pharmaceutical products. In this field, “improving the quality of pharmaceutical products” and “optimal packaging” were identified and examined.

2.3.1 The quality of pharmaceutical products: Some challenges related to the quality of pharmaceutical products are the following: Decreased quality of manufactured medicines and occurrence of unhealthy behaviors in the field of health, lack of investment in the quality of domestically manufactured medicines, the same pricing for medicines with different qualities, pharmaceutical manufacturing factories establishment regardless of international standards, lack of Good Manufacturing Practice (GMP) qualifications, and not obtaining international certificates needed for pharmaceutical export. According to the representative of Iran-UAE Joint Chamber of Commerce:

"Many of our factories have been established without complying with international standards; thus, when entering the field of export, even to neighboring countries, unfortunately, they will face challenges regarding production standards of destination countries". (the SOHDI of Iran, September 25, 2019).

2.3.2 Packaging: Some news outlets stated the weakness of the packaging industry, the need for cash payments to provide packaging requirements and the increased cost of pharmaceutical products packaging as packaging challenges in the pharmaceutical industry. While pointing out these challenges, the CEO of a pharmaceutical company stated:

"Unfortunately, we are facing a situation where we have more problems in supplying domestic necessities than imported necessities; so, we need cash payments for supplying boxes, brochures, cartons, etc., creating a heavy financial burden for us" (Salamat News, September 8, 2018).

3. Financing

One of the controlling factors in the health system, spesifically the pharmaceutical industry, is financing. The financing issues identified in this study were “ ability to pay receivables”, “international financial transactions and exchanges", “investment”, and “pharmaceutical pricing policy and system”:

3.1 Ability to pay receivables: One of the responsibilities of the government, insurance companies, medical centers, and pharmacies is to deliver the pharmaceutical companies' receivables. “Receivables” and “Liquidity” were the identified components of this issue.

3.1.1 Receivables: Pharmaceutical companies receivables from insurance organizations, prolonging the receivable payments period, working capital problems, delays in receivable payments from the National Development Fund, and wrong choice of Health Insurance Organization to pay receivables were some of the identified challenges in this field. Concerning these problems, the spokesman of the Food and Drug Administration stated:

" … but the market trend … is such that after the manufacturing and sale of medicines, the pharmaceutical companies' receivables are not paid in cash, and due to delayed payments by insurance companies, receivables are in arrears. The time period for payment of pharmaceutical companies receivables has increased." (Phana, April 16, 2018).

3.1.2. Liquidity: Lack of liquidity due to poor government's performance, non-payment of receivables by insurance organizations, pharmaceutical pricing, liquidity challenges, and their impact on pharmaceutical raw materials and pharmaceutical supply chain were identified as liquidity-related challenges. In this regard, a pharmaceutical industry activist stated:

"A major problem the pharmaceutical industry faces is the lack of liquidity in the pharmaceutical drug market, which has caused drug shortage" (Salamat News, April 30, 2019).

3.2 International financial transactions and exchanges: One of the issues related to the pharmaceutical industry's financing is international financial transactions and exchanges of which “exchange rate” and “LC” and banking transactions” were the identified components in this context.

3.2.1 Exchange rate: Findings indicated that the rising exchange rate, low value of the domestic currency, medicine smuggling due to multiple-exchange rates, currency outflow from import, allocation of government's currency to medicine imports, and instability and exchange rate fluctuations were some exchange rate challenges. For instance, the representative of Tehran University of Medical Sciences stated:

"The results of a study showed that a one-percent increase in exchange rate fluctuations on average can reduce 17 percent of exports of medical equipment and medicine in the short term" (Sepidonline, January 1, 2020).

3.2.2 LC and banking transactions: Based on the results of the present study, the restriction on opening LC accounts was a challenge in banking transactions, so that one of the members of the Islamic Consultative Assembly mentioned:

"Banking sanctions have targeted money transfer, LC and banking transactions, and may reduce maneuvering power" (Khane Mellat News Agency, May 11, 2018).

3.3. Investment: One of the ways to develop the pharmaceutical industry is to invest in domestic and foreign markets.

3.3.1 Foreign investment: They cover the investments made by other countries in Iran, by Iran in other countries, and joint investments and ventures. Issues such as insufficient foreign investment in Iran, difficulties in attracting foreign investors and domestic resistance to it, unwillingness of foreign companies to invest due to political issues, and constant changes in the policies of the Ministry of Health and its affiliated organizations were identified challenges in this context. According to the representative of the Chamber of Commerce:

"Strict and unprofessional programs of the Ministry of Health have made the presence of foreign companies in our country and pharmaceutical manufacturing non-cost-effective. For this reason, … only under the license of foreign companies has production started". (TCCIMA, June 19, 2017)

3.3.2 Domestic investment: This section focuses on Iranian investment in the country's pharmaceutical industry. Lack of government support for new investments in the industry, inadequate investment, inability of the private sector and improper investment of governmental industry in this field, and the unique approach adopted by state-owned and quasi-state-owned pharmaceutical companies were some of the domestic investment challenges. As the representative of the Chamber of Commerce mentioned:

"Most pharmaceutical companies are state-owned or quasi-state-owned factories and do not make new investments, …" (TCCIMA, April 9, 2017).

3.4 Pharmaceutical pricing policy and system: One of the stages of pharmaceutical manufacturing is its pricing, which is affected by the costs incurred in different manufacturing stages. In this regard, pharmaceutical pricing policies addressed pharmaceutical prices, drug pricing mechanisms, and subsidies as discussed below.

3.4.1 Pharmaceutical prices: Inconsistency between manufacturing costs and domestic pharmaceutical prices, pharmaceutical manufacturing costs exceeding domestic pharmaceutical sales prices, unrealistic domestic pharmaceutical prices, price suppression due to government financial inability, and imposing unreasonable fees on the pharmaceutical industry were some challenges of the pharmaceutical pricing system. In response to the question of what factors have caused the crisis in the pharmaceutical industry, the former chairman of the Food and Drug Administration added:

"Part of the industry's problems are due to the unrealistic prices of domestically manufactured medicines" (Sepidonline, December 19, 2017).

3.4.2 Pharmaceutical pricing mechanism: Some of the identified pharmaceutical pricing challenges in this study were changing the basis of pharmaceutical pricing. They are unfair competition, the difference in prices of domestically manufactured medicines and imported medicines due to pricing method and improper pricing system, and not applying the new one. According to the spokesman of the Food and Drug Administration:

"If we can go in the direction of changing the pharmaceutical pricing mechanism from the situation based on cost-price to reference-price and change the basis of pharmaceutical pricing, we can hope for the development of the country's pharmaceutical industry" (Phana, April 16, 2018).

3.4.3 Subsidies: Elimination of subsidies for the export of pharmaceutical items which received subsidies directly and forcing pharmaceutical exporters to return pharmaceutical subsidies were some of the challenges. One of the members of the Islamic Consultative Assembly stated:

"The export of medicine is not so substantial, such that the government wants to withdraw subsidies from exporters" (Khane Mellat, October 7, 2017).

- Marketing

“We have made many efforts for the export and registration of medicines abroad, but unfortunately, Iran’s industry is not well familiar with marketing abroad” (Salamat News, January 23, 2018).

4.1. Branding: This is to introduce domestically manufactured pharmaceutical products, build trust to absorb investment, and increase the likelihood of pharmaceutical export. It is done by increasing marketing efficiency and effectiveness, creating a sense of customer loyalty to the brand, improving profitability margin, gaining leverage among customers, and achieving a different competitive advantage.

4.1.1 Advertising: Weakness and prohibition of advertising activities for domestically manufactured pharmaceutical products were some challenges in this area as pointed out by the chairman of the Food and Drug Administration:

"We have poor performance in promoting domestically manufactured medicines, and this has made us somewhat incapable of introducing capabilities of the pharmaceutical industry to the people and the world" (Salamat News, October 15, 2019).

4.2 Export pharmaceutical products: Exporting pharmaceutical products include domestically manufactured medicines which are exported to target markets. One of the challenges in this area was related to medicinal plants.

4.2.1 Herbal medicines: Despite the existence of various species of medicinal plants in Iran, the necessary infrastructure for the production of herbal medicine does not exist. For this reason, medicinal plants are exported abroad, and herbal medicines are produced and imported into the country. Other challenges in this area are doctors' disregard for traditional medicine and herbal medicines, excessive harvesting of natural resources, collecting plants from sources by non-specialized people, mismatch between the production of herbal medicines and their manufacturing capacity, and the impossibility of extracting high-tech plants. According to the head of the Pharmacy Committee of the Scientific Association of Traditional Medicine:

"In Iran, many companies are operating in the field of herbal medicine production, but the amount of production is not commensurate with the country's capacity" (Salamat News, July 11, 2017).